MUFG expects the European Central Bank to resume easing in June, arguing that a wide range of disinflationary forces leave little justification for delaying a return to neutral policy settings. The bank anticipates a 25bp cut next month, likely accompanied by a downgrade to the ECB’s official inflation forecasts.

- euro area inflation now facing well-defined downside risks — from weaker domestic demand, falling energy prices, and trade diversion

- little reason to postpone normalising rates back to at least neutral, around 2%

ECB President Christine Lagarde recently acknowledged these risks, which MUFG views as more concrete than ongoing supply-side uncertainties. The analysts also flagged continued ambiguity around the scale and timing of potential fiscal stimulus measures, particularly in Germany, as a factor reinforcing the ECB’s short-term dovish tilt.

MUFG expects one further cut in the second half of 2025, which would bring the deposit rate to 1.75% — a level the bank considers neutral or mildly accommodative. Beyond that, policymakers may pause, as clarity emerges around the trajectory of German fiscal support and potentially higher European defence spending.

- By year-end, greater visibility on the fiscal outlook could give the ECB the confidence to call time on the current easing cycle

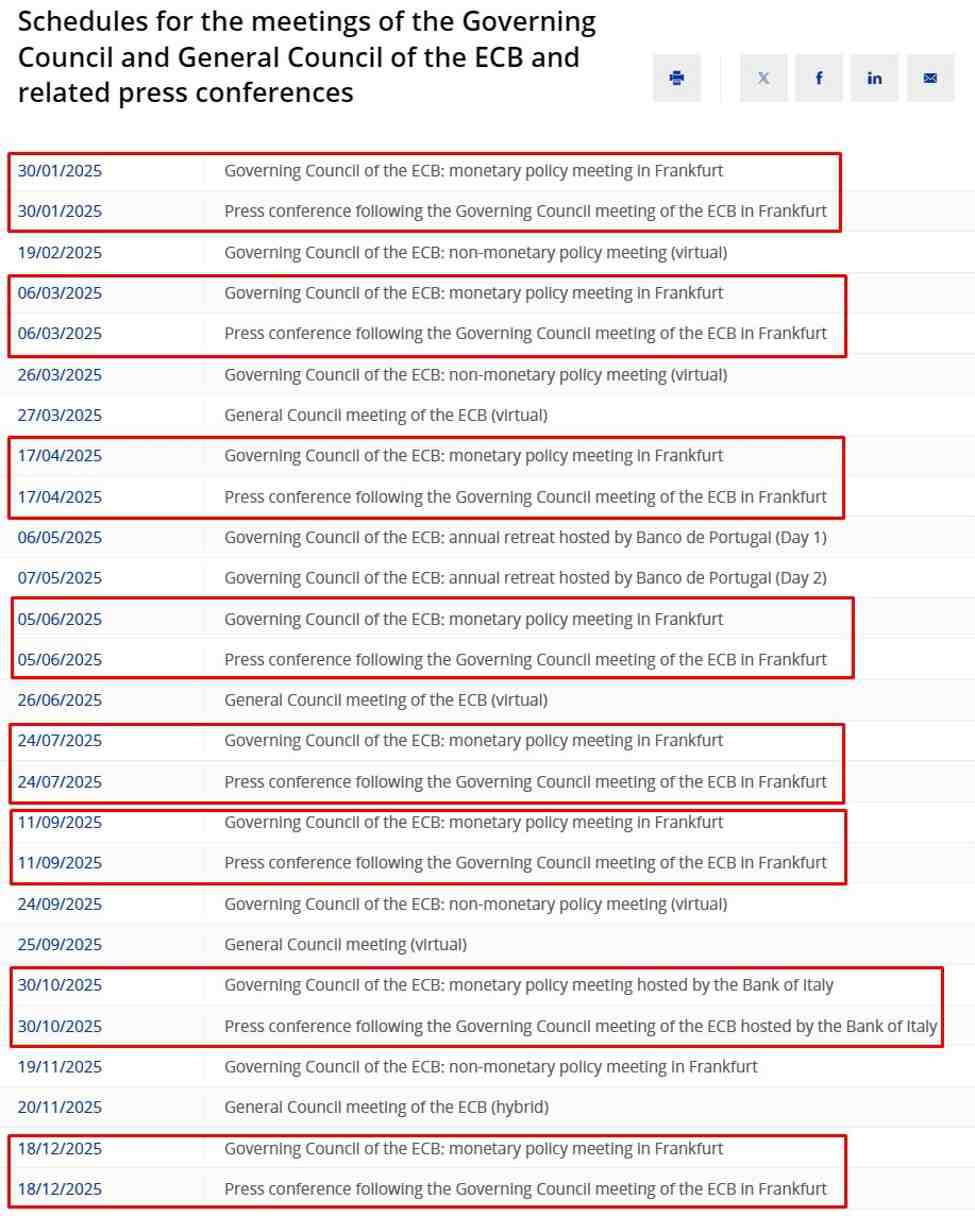

The next meeting is June 5

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.