Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

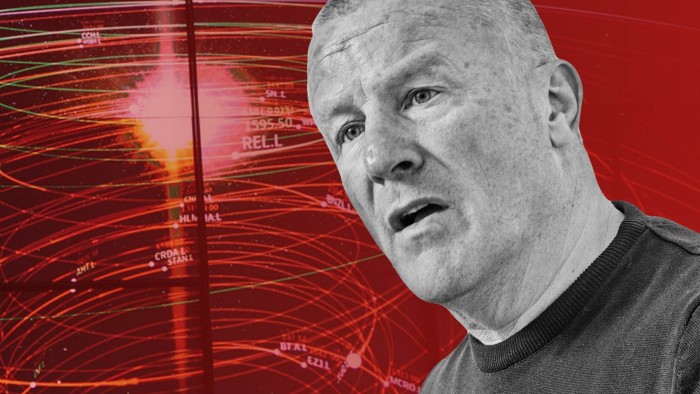

Neil Woodford picked an auspicious week to try a resurrection. The former UK fund manager, whose eponymous investment boutique collapsed in 2019, announced plans for a new “investment strategy platform” — dubbed “W4.0” — on Holy Monday.

Woodford was once accused by regulators of having a “defective” understanding of his responsibilities for managing liquidity risks. It is for higher powers to decide whether he deserves forgiveness. Irrespective, this pitch for a new service offering “followable investment strategies designed by Neil Woodford, that you can act on through your existing account”, presents some obvious flaws.

The emphasis on letting customers make changes and execute trades through their own brokers seems to distinguish W4.0 from regulators’ formal definition of “copy trading”, but the basic attraction is the same. Amateur investors feel like they’re getting guidance from someone knowledgeable, while still having more agency than if they just stuck their money into an index tracker.

There is clearly a demand for this. EToro, the market leader in copy trading, grew from about half a million accounts in 2019 to more than 3mn in 2024. But just because it is popular doesn’t make it wise. EToro says about 35 per cent of its “popular investors” — the accounts that regular users can choose to copy — beat the S&P 500 in 2024, but doing so consistently is much harder. EToro’s most popular trader has only beaten the US index in two of the past five years.

Woodford seeks to position himself as the mature alternative to reckless, gambling-like strategies. But copy trading can create perverse incentives to make wild bets or transact more regularly. Why bother paying a monthly subscription fee for a portfolio that looks just like everyone else’s, or which stays the same for extended periods?

W4.0’s original sin is the assertion, right at the start of the web post introducing the platform, that “the financial products most people are offered still look a lot like they did 30 years ago: rigid, opaque and expensive”. It is true that most retail investments still go through traditional-looking structures — even exchange traded funds could be seen as a variation on an old theme — but the growth of ETFs and index trackers has nonetheless given consumers far more options than they used to for cheap, transparent and effective investing.

There is evidence that investors are quite happy with the change. The percentage of retail assets under management in index-tracking funds surged from 11 per cent in 2015 to 25 per cent in 2024, according to the Investment Association.

Woodford complained on a recent podcast that he never had the opportunity to repair his performance after the extended period of losses that led to the collapse of his boutique. But even a successful W4.0 wouldn’t be able to reverse the decline of the “star manager” culture he once epitomised. The meeker funds are already inheriting the earth.