- The AUD/USD weekly forecast shows a resilient Aussie.

- Inflation in Australia increased by a smaller-than-expected 2.4%.

- Economists believe the RBA will keep rates unchanged.

The AUD/USD weekly forecast shows a resilient Aussie as market participants gear up for the RBA meeting and Trump tariffs.

Ups and downs of AUD/USD

The AUD/USD pair had a slightly bullish week as the Australian dollar gained despite weak inflation figures from Australia. However, the pair closed below its highs. Meanwhile, the dollar fluctuated between gains and losses as traders worried about looming tariffs and absorbed upbeat US data.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Data on Wednesday revealed that inflation in Australia increased by a smaller-than-expected 2.4%. However, RBA policymakers are likely to remain cautious due to high underlying inflation. Meanwhile, Trump confirmed an automobile tariff starting next week that might escalate global trade tensions.

Next week’s key events for AUD/USD

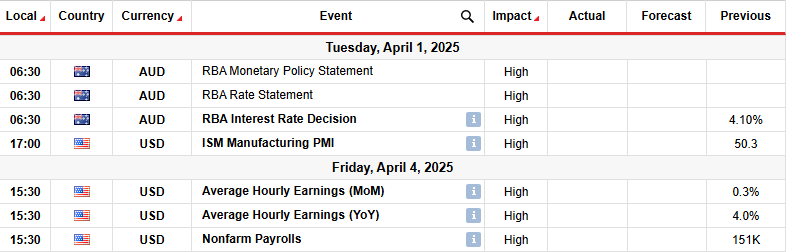

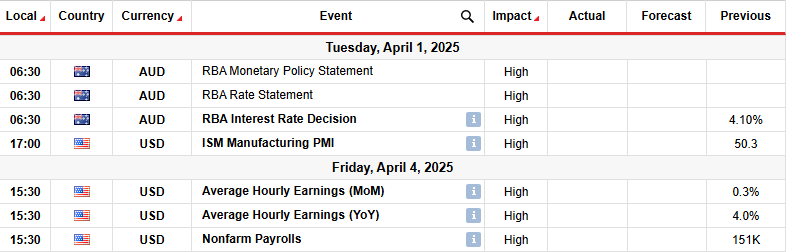

Next week, market participants will focus on the Reserve Bank of Australia policy meeting. Additionally, they will focus on monthly employment data from the US.

The RBA implemented its first rate cut in February. However, this time, economists believe the central bank will keep rates unchanged. Meanwhile, the US might record slower job growth, with the unemployment rate holding at 4.1%. A surprising figure will cause volatility and shape the outlook for Fed rate cuts.

AUD/USD weekly technical forecast: Bears set their sights on the 0.6100 support

On the technical side, the AUD/USD price trades slightly below the 22-SMA with the RSI below 50, suggesting a bearish bias. However, the price has been chopping through the SMA since it paused near the 0.6100 support level.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

Initially, AUD/USD was in a developed downtrend, keeping below the 22-SMA with the RSI under 50. However, the decline paused when the price reached the 0.6100 support level. Here, it entered a corrective phase in which bulls and bears were almost equally matched.

This corrective move rose and paused at a solid resistance zone comprising the 0.382 Fib retracement and the 0.6390 level. Currently, bears are trying to push off the 22-SMA. A surge in momentum next week might allow the price to retest the 0.6100 support. A break below this level will confirm a continuation of the downtrend. On the other hand, if bulls overpower bears, the price will break above the SMA and the resistance zone to start making higher highs and lows.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.