- The USD/CAD weekly forecast indicates unexpected strength in Canada’s economy.

- US data this week came in higher than expected, easing fears of a recession.

- There is uncertainty over Trump’s looming tariffs.

The USD/CAD weekly forecast indicates unexpected strength in Canada’s economy that is keeping the loonie afloat.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week as the Canadian dollar strengthened despite fears of a looming 25% tariff on Canada. Meanwhile, uncertainty regarding Trump’s April tariffs kept traders on the sidelines.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

US data this week came in higher than expected, easing fears of a recession. These included business activity, GDP and inflation figures. As a result, the dollar rebounded. However, uncertainty over Trump’s looming tariffs kept a lid on gains.

Meanwhile, the Canadian dollar gained after data revealed a bigger-than-expected expansion in Canada’s economy. The currency performed well despite a dimming outlook for the economy due to Trump’s tariffs.

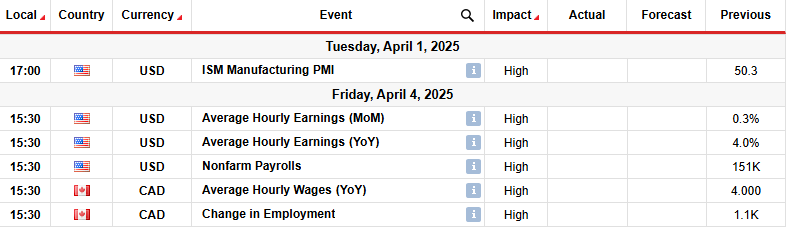

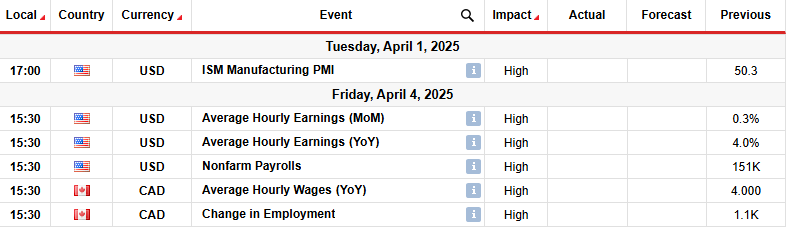

Next week’s key events for USD/CAD

Next week, both the US and Canada will release crucial monthly employment data showing the state of their labor markets. Economists forecast a slight increase in job growth in Canada. However, the unemployment rate might also edge higher. Meanwhile, in the US, job growth might ease in March, with the unemployment rate holding at 4.1%.

Better-than-expected figures will lower expectations for BoC and Fed rate cuts. On the other hand, weakness in the labor market would pile pressure on both central banks to lower borrowing costs.

USD/CAD weekly technical forecast: Price remains in consolidation

On the technical side, the USD/CAD price is below the 22-SMA, and the RSI is under 50, indicating a bearish bias. However, the price also trades in a range between the 1.4175 support and the 1.4502 resistance level. It entered this range after a solid bullish rally. An attempt to continue the uptrend failed when the price met the 1.4804 resistance. As a result, the price fell back into the consolidation area.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

Within the range, bears are in the lead. Therefore, the price might soon retest the range support. A break below this level would confirm a bearish reversal, allowing the price to retest the 1.3802 support.

On the other hand, if bulls take back control within the range, the price will retest the 1.4502 resistance. A break above this level would confirm a continuation of the previous bullish trend.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.