Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

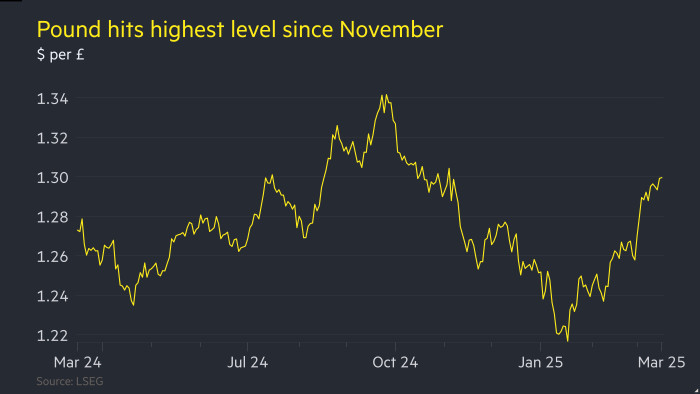

The pound has climbed above $1.30 for the first time since early November, helped by persistent UK inflation and a broad weakening in the dollar.

Sterling rose above the level in early trading on Tuesday for the first time since the days after the US election. It has climbed around 3 per cent so far this month, helped by a decline in the dollar as investors worry that President Donald Trump’s stop-start trade war is harming the US economy. The pound later fell back to $1.297, down 0.2 per cent on the day, in afternoon trading.

Sterling’s gains mark a reversal since January, when concerns over the outlook for the UK’s public finances knocked the currency and UK government bonds. Since then, higher than expected inflation has prompted bets that the Bank of England would be slower to cut interest rates than previously thought.

“The pound is along for the ride, as it has better interest rates support . . . UK fiscal concerns are still out there but on the back burner for now,” said Brad Bechtel, a global head of FX at Jefferies.

After hitting a two-year high following the US election, as investors bet that Trump’s tariffs and other economic policies would boost inflation, the dollar has fallen sharply since January as investors focus more on the potential economic damage from erratic policymaking in the White House.

“It sends another reminder that market participants are no longer confident that President Trump’s policies will boost US growth and strengthen the US dollar,” said Lee Hardman, senior currency analyst at MUFG.

Craig Inches, head of rates and cash at Royal London Asset Management, said sterling’s strength was a combination of a “fear of US slowdown leading to more Fed cuts” versus an expected uptick in UK inflation data that will make it harder for the BoE to cut borrowing costs. In January, inflation rose more than expected to 3 per cent.

The BoE is widely expected to hold interest rates steady at 4.5 per cent at its meeting on Thursday. Levels in swap markets suggest traders believe the BoE and the Federal Reserve will make two further quarter-point cuts this year, with the Fed more likely to make a third.

The upward move for sterling comes despite the OECD this week lowering its growth forecast for the UK, as countries around the world are hit by the fallout from US tariffs. The Paris-based body now expects UK GDP growth for 2025 to be 1.4 per cent, a 0.3 percentage point reduction from its previous calculation.

But the pound has weathered trade concerns this year, as investors bet the UK is less exposed to tariffs than some other economies.

Last week, UK Prime Minister Sir Keir Starmer said he was “disappointed” by the US’s latest tariff salvo on steel and aluminium, but that the country would keep “all options on table” in terms of a response to the US administration.