The prop

trading industry has just witnessed its most dramatic shake-up yet. Over the

past year, between 80 and 100 proprietary trading firms have shut down,

challenge pass rates have plummeted, and the average trader’s investment has

dropped by 50%. Yet, amid the chaos, a few dominant players are emerging

stronger than ever.

Even 100 Prop Firms Gone

in 2024

According

to estimates gathered by Finance Magnates Intelligence, between 80 and

100 proprietary trading firms may have disappeared from the market in 2024. This aligns with data presented by FunderPro mid-year, which estimated that the number had already reached around 50 firms at that time.

At the

heart of this upheaval is a single industry-altering event—MetaQuotes’ decision

to step back from supporting prop firms. This move sent shockwaves through the

market, forcing traders and firms to rethink their strategies, diversify

platforms, and ultimately accelerate industry consolidation.

“I expect

many more prop firms to close, cease or halt operations and/or find themselves

on the wrong end of lawsuits and social media attacks,” Justin Hertzberg, the

CEO of FPFX warned.

The numbers

tell the story. 300,000

prop trading accounts analyzed by FPFX Tech reveal a fundamental shift in

trader behavior. While MetaTrader 5 still holds a 61.9% market share,

alternative platforms like cTrader, DXtrade, MatchTrader, and TradeLocker have

seized the opportunity, reshaping

a once-monopolized space.

But here’s

the real shocker: as dozens of firms collapsed, one

of the largest prop firms just acquired a major FX/CFD broker. The

consolidation is happening fast, and only the strongest are surviving.

Meanwhile,

pass rates have fallen, and payouts have tightened—suggesting

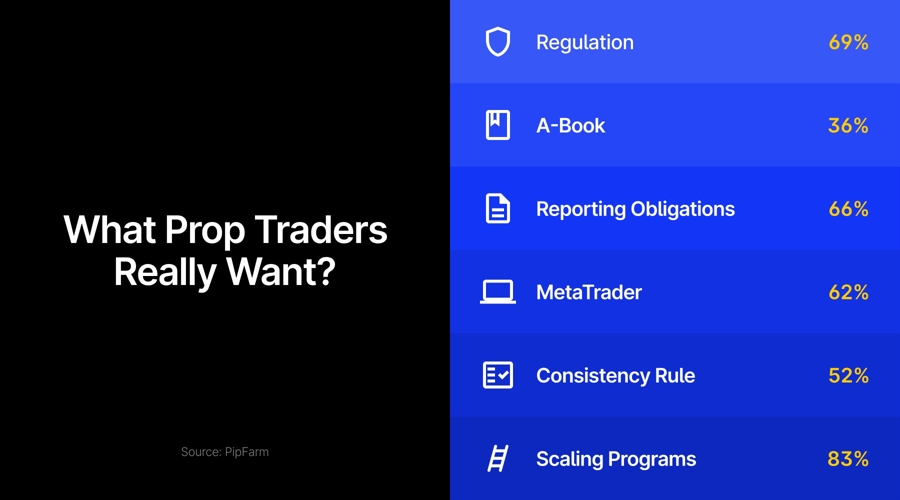

an industry favoring survival over speculation. The profile of the “average prop trading Joe” has changed, and we have the data:

Is prop

trading still the high-growth phenomenon it once was? Who are the winners and

losers in this shifting landscape? And what does this mean for retail traders?

Find out

in the Finance Magnates

Quarterly Industry Report, where we break down the data, the trends, and

the next big moves shaping prop trading in 2025.

This article was written by Damian Chmiel at www.financemagnates.com.

Source link