- The AUD/USD weekly forecast shows continued strength in Australia’s labor market.

- The Reserve Bank of Australia implemented its first rate cut this week.

- Data revealed a sharp decline in business activity in the US service sector.

This AUD/USD weekly forecast highlights the significant impact of Australia’s strong labor market on the appreciation of the Australian dollar.

Ups and downs of AUD/USD

The AUD/USD pair had a bullish week despite an RBA rate cut on Tuesday. The strength came from an upbeat employment report from Australia and a weak dollar.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The Reserve Bank of Australia implemented its first rate cut this week but remained cautious due to labor market strength. Data on Thursday revealed an unexpected jump in job growth in Australia. Meanwhile, the US dollar was fragile amid hopes for a trade deal between the US and China. At the same time, data on Friday revealed a sharp decline in business activity in the US service sector.

Next week’s key events for AUD/USD

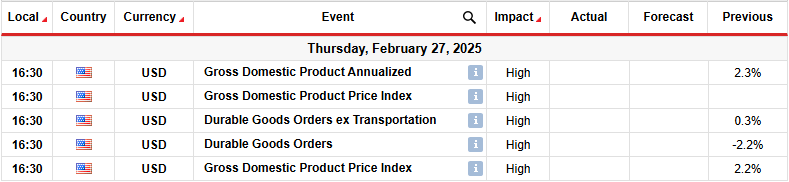

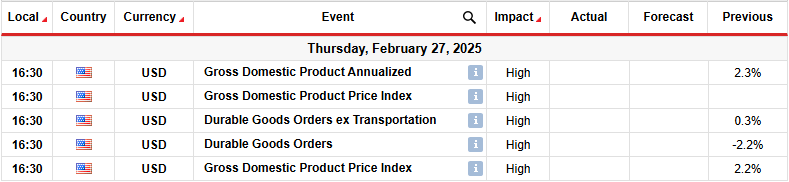

Next week, market participants will focus on US GDP and core durable goods data. The US economy has shown resilience in 2025, with only a few weak spots, such as retail sales. As a result, the outlook for the Fed remains mostly hawkish, with market participants expecting only two cuts this year.

Upbeat GDP data might further lower rate-cut expectations, boosting the dollar. On the other hand, if economic growth disappoints, rate cut expectations will increase, hurting the greenback

AUD/USD weekly technical forecast: Bulls face the 0.382 Fib retracement level

On the technical side, the AUD/USD price trades above the 22-SMA with the RSI above 50, supporting a bullish bias. The trend recently reversed when bears paused at the 0.6100 support level. Bears gradually lost momentum as the price approached this level, allowing bulls to emerge and break above the 22-SMA. At the same time, the RSI broke above 50, indicating stronger bullish momentum.

However, bulls face a strong resistance zone comprising the 0.382 Fib retracement and the 0.6401 key level. If the bulls are strong, they will break above this zone to make new highs. However, the price might pull back to retest the SMA before climbing higher.

On the other hand, if the zone holds firm, bears might overpower bulls to break below the SMA and retest the 0.6100 support. A break below this level would confirm a continuation of the previous downtrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.