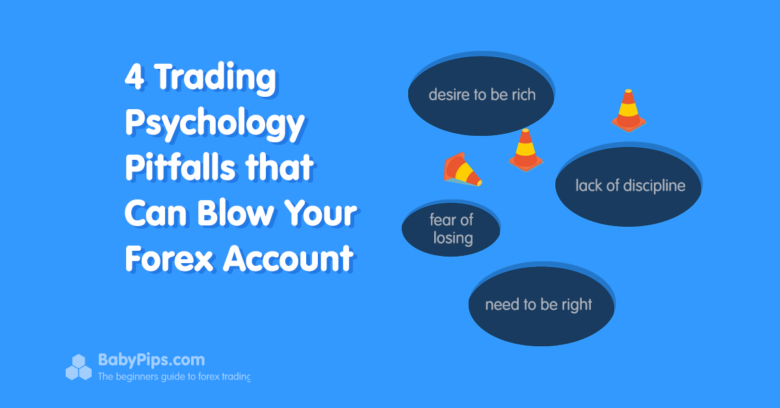

I’ve noticed that newbie traders are susceptible to four main psychological pitfalls.

Hopefully, after reading this, you will be able to see them coming and stop them before they destroy your account.

Let’s take a look at each one and examine them carefully.

1. The desire to be rich

The desire to get rich can show up in all sorts of ways, but it mostly boils down to fear and greed. And these two troublemakers often lead to even bigger problems.

When you think about it, most of the issues that newbies run into can be traced back to the urge to get rich quickly.

When you think about it, most of the issues that newbies run into can be traced back to the urge to get rich quickly.

Overtrading? Check.

Poor money management? Double check.

These are crowd favorites for a reason.

But here’s the truth: Forex trading isn’t a get-rich-quick scheme. It’s not going to turn you into a millionaire overnight. In fact, it’ll probably take years before you’re skilled enough to make trading your full-time gig.

Trading forex is a long game. If you play it right, it can give you a comfortable, laid-back lifestyle. But if you started trading last week, and you’re already planning to quit your job in six months to buy a Ferrari, well, you might want to pump the brakes.

The reality is, that chasing quick riches is a surefire way to crash and burn. Instead, focus on building strong trading habits, managing risk, and playing the long game. That’s how you build a lasting career in forex.

2. Fear of losing

From a young age, many of us were taught that success is all about having a lot of money and that losing money, the opposite of making it, means failure. It’s no wonder so many traders are afraid of losing money.

Some newbies stick to demo accounts for years, never quite finding the courage to trade live. Others jump into live trading but panic as soon as they are in a trade, often making rash decisions that do more harm than good.

But here is the thing: Losing money to the markets is not always a bad thing. In fact, it can teach you some of the most valuable lessons in trading.

When you are fixated on the possibility of loss, you are more likely to make emotional decisions instead of rational ones. So, ditch those fears and worries—they will only hold you back.

Truth is, losing money in the markets is part of the game. It’s unavoidable. Every professional trader has taken losses. Not every trade will go your way.

The market does not always play nice, and especially when you are just starting out, you are bound to find yourself on the wrong side of a trade. If you end up blowing your first live account, so be it.

What matters is how you respond. As long as you get back up, learn from your mistakes, and try again, you will come out a better trader. I have been there myself—I blew up two accounts before I started trading profitably.

3. The need to be right

Tom, who enjoys forex trading, opens his platform and enters a dumb, baseless, long trade. He targets 100 pips and has a 50-pip stop loss. The trade goes against him immediately.

It goes down, first ten pips, then twenty pips, and then thirty pips. When it reaches forty pips, Tom decides he doesn’t want to lose another trade and moves his stop loss down.

The price keeps falling and Tom continues to move his stop.

100

120

150……

Eventually, Tom closes out his trade and he has lost a huge portion of his account.

Tom was not able to accept that he had taken a losing trade. He kept pushing the stop down in the hope that it would eventually turn around. The need to be right is an account killer.

4. Lack of discipline

I saved this one for last because, even though it is one of the most common and dangerous pitfalls, it is rarely discussed.

A trader who lacks discipline can never make it in this business. And many traders are guilty of lacking discipline for many different reasons.

The main culprits are what I like to call “System Jumpers.” These are traders who are constantly tweaking and changing their trading methods. They don’t realize that learning to trade a system efficiently takes time.

System Jumpers are traders who lack the discipline to stick to and learn how to trade a system. They try it for a week and when it doesn’t work they jump to the next system or method.

Another common action of an undisciplined trader is abandoning a perfectly good trading method.

Every trading method has periods in which it performs below average. No matter how versatile a method is, it cannot perform at peak efficiency in all market conditions. A true trader has the discipline to stick it out through the hard times.