- The USD/CAD weekly forecast indicates dollar weakness amid easing tariff tensions.

- Data on Wednesday revealed that US consumer inflation rose by 0.5% in January.

- Reports that Trump’s reciprocal tariffs would not come immediately boosted risk appetite.

The USD/CAD weekly forecast indicates improving risk appetite amid easing tariff tensions that keep pressure on the dollar.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week as the dollar dropped from its peaks due to easing tariff fears. At the start of the week, traders focused on Powell’s speech. The Fed Chair maintained his hawkish tone, saying there was no rush to lower borrowing costs.

-If you are interested in forex day trading then have a read of our guide to getting started-

Meanwhile, data on Wednesday revealed that US consumer inflation rose by 0.5% in January, beating forecasts of 0.3%. The upbeat report led to declining Fed rate cut expectations, briefly boosting the dollar. However, reports that Trump’s reciprocal tariffs would not immediately boost risk appetite, hurt the US dollar. Furthermore, data on Friday revealed that US retail sales dropped more than expected.

Next week’s key events for USD/CAD

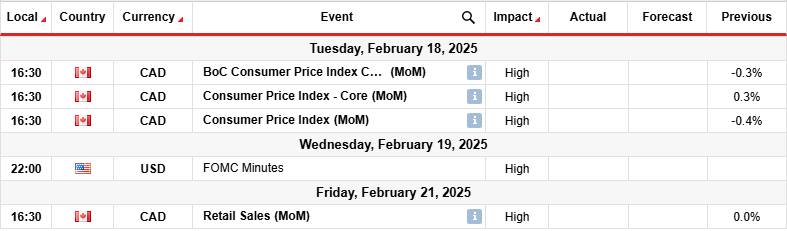

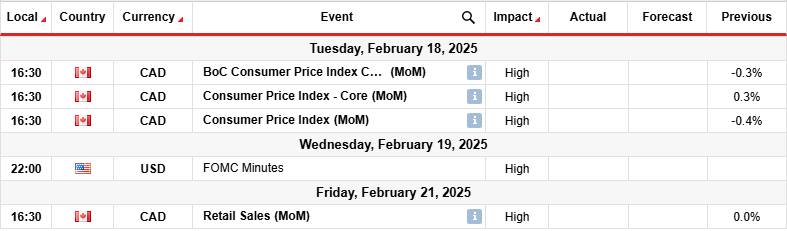

Next week, investors will monitor inflation and retail sales data from Canada. Meanwhile, the US will release the FOMC policy meeting minutes. Canada’s inflation reading will shape the outlook for Bank of Canada rate cuts. A bigger-than-expected number will lower bets for a rate cut, boosting the Canadian dollar. On the other hand, if inflation is softer than forecast, rate-cut bets will rise, hurting the loonie.

Meanwhile, the FOMC meeting minutes will show where policymakers stand on future rate cuts.

On the technical side, the USD/CAD price has broken below the 1.4300 support level, pushing lower below the 22-SMA. The move comes after the price made a solid bearish engulfing candle, signaling a likely reversal.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Previously, USD/CAD traded in a strong uptrend, making higher highs and lows and respecting the 22-SMA as support. However, bears started gaining on bulls after the price broke above the 1.4300 resistance level. The price started making bigger red candles and kept close to the 22-SMA. Still, bulls made one last attempt to stay in control by making a higher high. However, the RSI made a lower high, showing weaker bullish momentum.

Therefore, bears overpowered bulls and reversed the trend, pushing the price below the 22-SMA. Bears are now eyeing the 1.4004 support level. A break below this level will strengthen the new bearish bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.