- The impact of Trump’s tariff threats faded during the week.

- Data on Friday revealed a significant improvement in Eurozone business activity.

- Economists expect the US Central Bank to keep interest rates unchanged.

The EUR/USD weekly forecast suggests a rebound in the Eurozone economy, reducing ECB rate cut expectations.

Ups and downs of EUR/USD

Due to upbeat Eurozone economic data, the EUR/USD pair had a bullish week. At the same time, the impact of Trump’s tariff threats faded during the week, allowing the currency to climb.

-Are you looking for automated trading? Check our detailed guide-

The US president has failed to give clear guidance on tariffs since he took office. This reduced the threat of a weaker Eurozone economy and lower borrowing costs.

Meanwhile, data on Friday revealed a significant improvement in Eurozone business activity. France and Germany showed improvements, easing pressure on the European Central Bank to lower borrowing costs.

Next week’s key events for EUR/USD

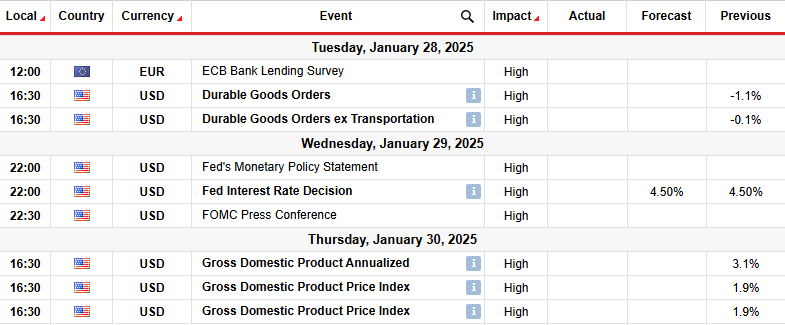

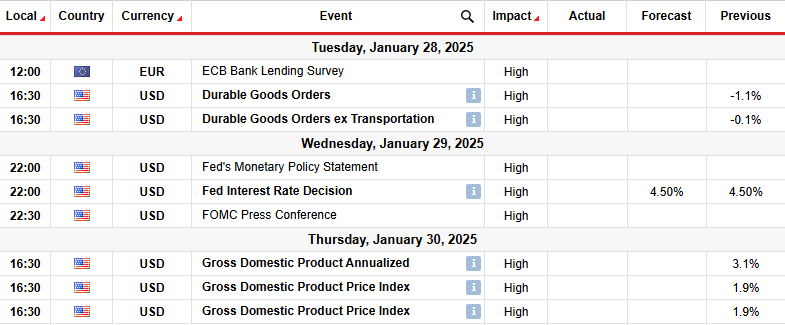

Next week, traders will focus on economic reports from the US on durable goods orders and gross domestic product. These will shape the outlook for Fed rate cuts this year. In the last two weeks, economic data has shown a slight slowdown in the US economy. If this trend continues next week, Fed rate cut expectations will increase, and the dollar will fall. On the other hand, upbeat data will lower rate cut bets and boost the greenback.

Meanwhile, economists expect the US Central Bank to keep interest rates unchanged during the Wednesday meeting. Additionally, traders will focus on the tone during the meeting.

EUR/USD weekly technical forecast: Bulls sighting 1.0603 resistance level

On the technical side, the EUR/USD price has broken above the 22-SMA to indicate a bullish sentiment shift. The break comes after the previous downtrend paused at the 1.0200 support level. The Bears showed exhaustion at this level as they struggled to make significant swings from the 22-SMA. At the same time, the RSI made a bullish divergence, indicating fading bearish momentum.

-Are you looking for forex robots? Check our detailed guide-

The break above the SMA has allowed bulls to set their sights on the 1.0603 resistance level. If the level holds firm, the price will pull back to revisit the SMA before continuing higher or dropping back to the 1.0200 support level. A break above 1.0603 will allow EUR/USD to start a new bullish trend. Furthermore, it will clear the path to the 1.0926 resistance level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.