- Data from Canada revealed that inflation eased to 2.4% annually.

- Canada’s retail sales made no change in November.

- Next week, investors will focus on policy meetings in Canada and the US.

The USD/CAD weekly forecast shows relief over Trump’s soft approach to tariffs supporting the Canadian dollar.

Ups and downs of USD/CAD

The USD/CAD pair had a bearish week as market participants focused on economic data and US political developments. Data from Canada revealed that inflation eased to 2.4% annually. Meanwhile, retail sales made no change in November. Nevertheless, the Canadian dollar gained on relief that Trump was not too aggressive in imposing tariffs.

-Are you looking for automated trading? Check our detailed guide-

On the other hand, the dollar eased on Friday after data revealed a significant drop in service sector business activity in the US. Downbeat data increases expectations for Fed rate cuts.

Next week’s key events for USD/CAD

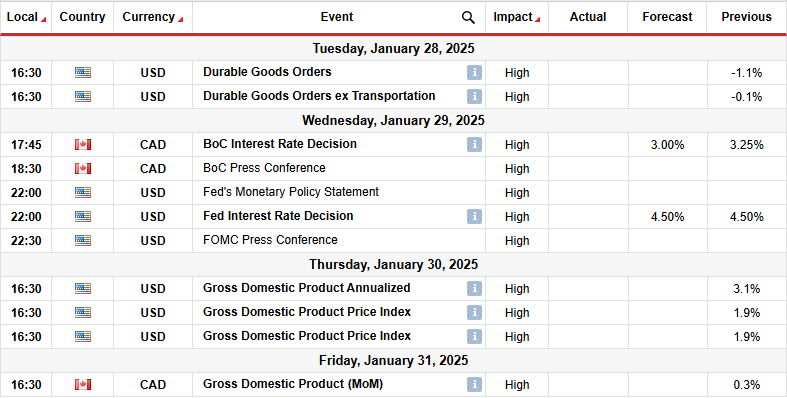

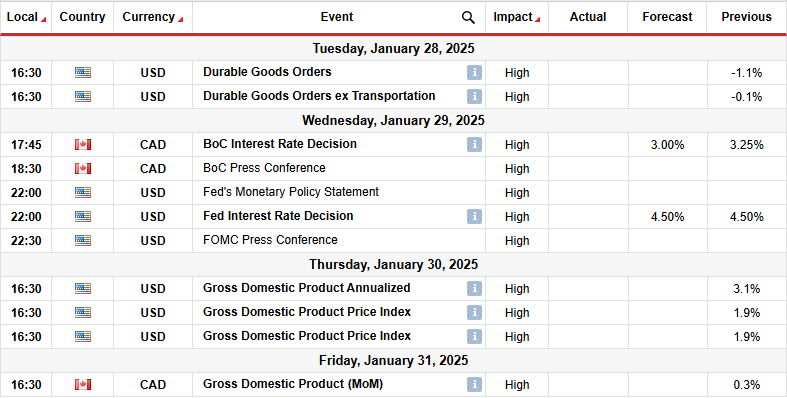

Next week, market participants will focus on data from the US, including durable goods orders and GDP. Moreover, the Fed will hold its policy meeting on Wednesday. The Bank of Canada will also hold its policy meeting on Wednesday. Meanwhile, GDP data from Canada on Friday will impact the Canadian dollar.

The GDP reports from Canada and the US will show the state of these two economies, shaping the outlook for monetary policy. The Fed will likely keep rates unchanged. However, traders will focus on messaging for future moves. Meanwhile, market participants expect the BoC to cut rates by 25-bps.

USD/CAD weekly technical forecast: Bears gear up for a trend reversal

On the technical side, the USD/CAD price has paused near the 1.4450 resistance level, where the price has started chopping through the 22-SMA. Before the pause, it was on a solid bullish trend, respecting the SMA as support.

-Are you looking for forex robots? Check our detailed guide-

At the same time, bulls kept making higher highs and lows until the price got to the 1.4450 level. Here, bears showed strength by making engulfing candlestick patterns. Moreover, although the price made slightly higher highs, the RSI made lower ones, indicating a bearish divergence.

The price currently trades below the 22-SMA, indicating a bearish shift in sentiment. If bears maintain this direction next week, the price might drop to the next support at 1.4003. Such an outcome would confirm a bearish reversal. However, the price will still have to make lower lows and highs to show a new downtrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.