The United Kingdom’s headline inflation rate unexpectedly cooled to 2.5% year-over-year in December 2024, coming in below market expectations of 2.7% and November’s reading of 2.6%.

The Office for National Statistics (ONS) data showed core inflation, which excludes volatile items, also moderated to 3.2% from 3.5% in November.

Key points from the ONS report:

- Annual Consumer price growth decelerated slightly to 2.5%y/y from 2.6% y/y

- Monthly CPI rose by 0.3% m/m, below forecasts of 0.4% m/m

- Core CPI showed continued moderation, falling to 3.2% annually

- U.K. services inflation, which is closely watched by the Bank of England, fell to 4.4% in December from 5% in November.

Link to ONS CPI Report for December 2024

Market Reactions

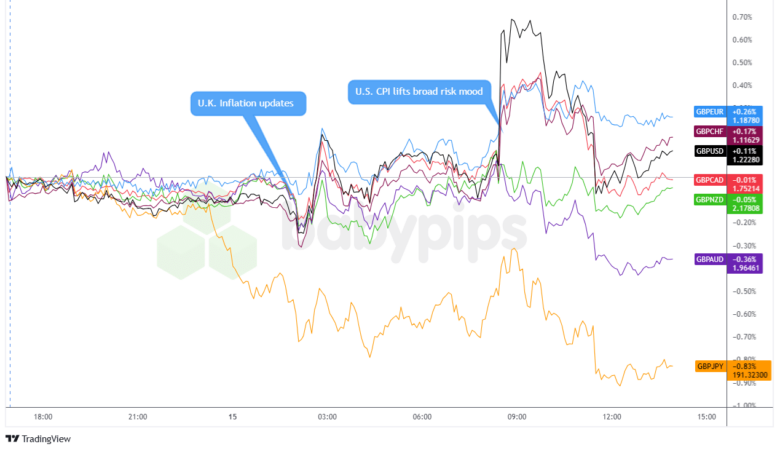

British pound vs. Major Currencies: 5-min

Overlay of GBP vs. Major Currencies Chart by TradingView

The British pound saw initial weakness following the softer inflation data as the print initially intensified market expectations for earlier Bank of England (BOE) monetary policy easing.

But Sterling quickly recovered some ground, which suggests that while traders are adjusting their rate expectations, they remain cautious about the broader inflation outlook given that many annualized metrics remain above target range, especially services inflation reads.

U.K. government bond yields responded more decisively to the news, with the 10-year gilt yield declining by more than 0.16 percentage point as investors increased their bets on earlier BOE rate cuts. This outcome provided some relief to recent turmoil surrounding the U.K.’s financial markets, likely another driver for the quick recovery

Focus shifted quickly to the U.S. CPI update during the U.S. session, prompting Sterling traders to price in that event’s influence on broad risk sentiment and U.S. dollar behavior, which was ultimately net positive for GBP as U.S. inflation rose less than forecast in December.

Sterling rallied against “safe havens” on the news while falling against AUD and NZD, as well as JPY, the latter of which had found strength on yen positive comments from Bank of Japan Governor Ueda during the previous Asia session.