People’s Bank of China USD/CNY reference rate is due around 0115 GMT.

The People’s Bank of China (PBOC), China’s central bank, is responsible for setting the daily midpoint of the yuan (also known as renminbi or RMB). The PBOC follows a managed floating exchange rate system that allows the value of the yuan to fluctuate within a certain range, called a “band,” around a central reference rate, or “midpoint.” It’s currently at +/- 2%.

How the process works:

- Daily midpoint setting: Each morning, the PBOC sets a midpoint for the yuan against a basket of currencies, primarily the US dollar. The central bank takes into account factors such as market supply and demand, economic indicators, and international currency market fluctuations. The midpoint serves as a reference point for that day’s trading.

- The trading band: The PBOC allows the yuan to move within a specified range around the midpoint. The trading band is set at +/- 2%, meaning the yuan could appreciate or depreciate by a maximum of 2% from the midpoint during a single trading day. This range is subject to change by the PBOC based on economic conditions and policy objectives.

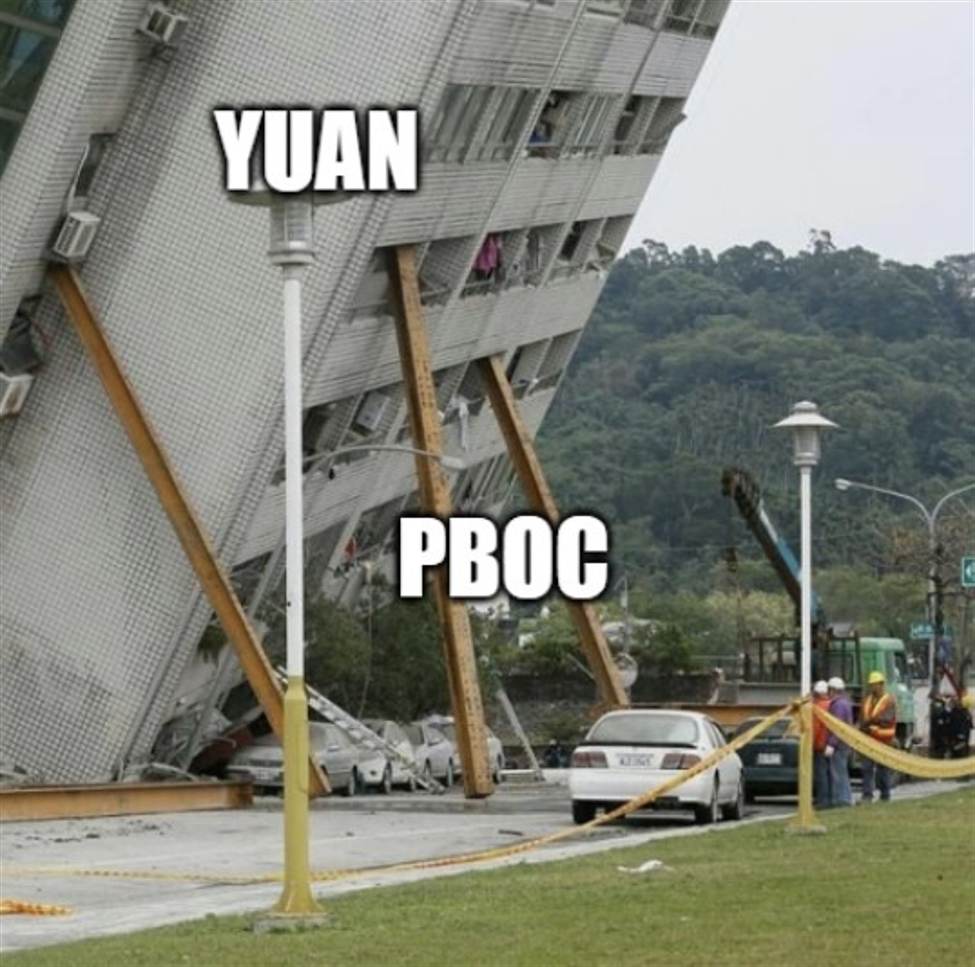

- Intervention: If the yuan’s value approaches the limit of the trading band or experiences excessive volatility, the PBOC may intervene in the foreign exchange market by buying or selling the yuan to stabilize its value. This helps maintain a controlled and gradual adjustment of the currency’s value.

ICYMI, me on the PBoC and yuan after the low, low, low inflation data for December published yesterday:

- The People’s Bank of China is wary of providing too much stimulus, such as a rate cut, due to financial stability and yuan weakness concerns.

- A political consideration now is that China will want to hold off on letting the yuan slide, keeping the threat of that happening in case its needed as a leverage tool in the event of Trump tariffs.

Also ICYMI – Yesterday Chinese banks cut consumer loan rates to scramble for business ahead of Spring Festival holidays .