- The US economy added a bigger-than-expected number of jobs in December.

- US unemployment fell, indicating a resilient labor market.

- Core inflation in Australia eased, boosting RBA rate cut bets.

The AUD/USD weekly forecast points south amid increasing RBA rate cut bets and lower expectations for Fed rate cuts.

Ups and downs of AUD/USD

This week, the Aussie collapsed as the dollar soared on upbeat data and RBA rate cut bets jumped. The US economy showed continued resilience, with reports on service sector business activity, jobs and unemployment claims beating forecasts. Moreover, the economy added a bigger-than-expected number of jobs in December, with the unemployment rate dropping. As a result, Fed rate cut bets fell.

-Are you looking for tips for forex trading? Check out the details-

On the other hand, Australia’s inflation figures last week revealed a slowdown in underlying price pressures. Consequently, rate cut bets for a Feb RBA rate cut increased, weakening the Aussie.

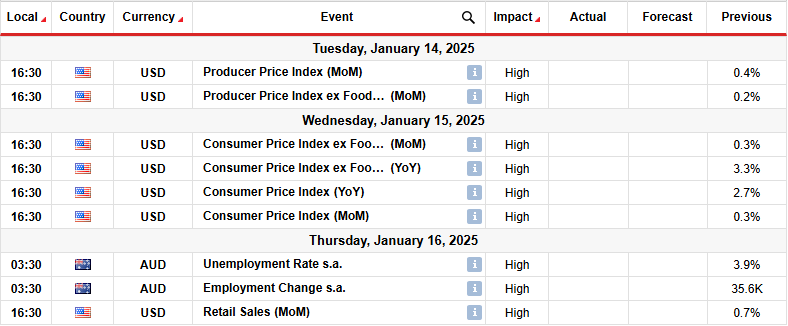

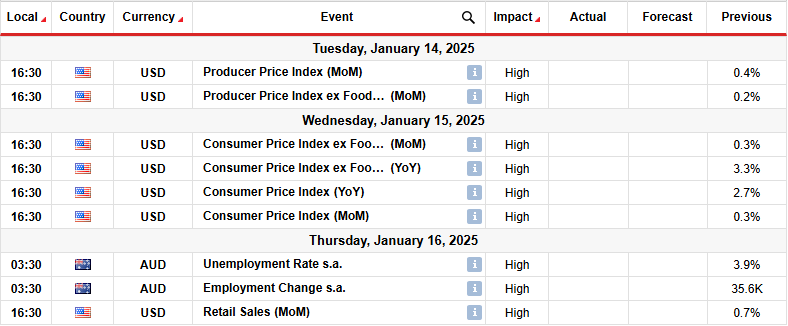

Next week’s key events for AUD/USD

Next week, traders will scrutinize inflation and retail sales figures from the US. Meanwhile, Australia will release its monthly employment figures. The Fed has forecasted only two rate cuts this year due to a resilient economy.

At the same time, inflation has stalled its decline, leading to policymakers losing confidence. If the US releases another upbeat report, markets might lower expectations to just one rate cut this year. On the other hand, a downbeat report will increase rate-cut bets, weighing on the dollar.

Meanwhile, market participants have increased bets for an RBA rate cut in February. A downbeat employment report will increase these bets, hurting the Aussie. On the other hand, if employment jumps, rate-cut bets will fall.

AUD/USD weekly technical forecast: Bears breach 1.272 Fib extension

On the technical side, the AUD/USD price has breached a significant support comprising the 0.6200 support and the 1.272 Fib extension level. The price has maintained a solid downtrend, trading below the 22-SMA resistance. Meanwhile, the RSI has maintained its position in bearish territory.

-Are you looking for crypto exchanges? Check our detailed guide-

Since the bearish bias is strong, there is a high chance AUD/USD will target the 1.618 Fib extension level next week. The downtrend will continue if the price stays below the 22-SMA and the RSI below 50.

On the other hand, if the price fails to hold its position below the 0.6200 level, it might bounce back to retest the SMA or the 0.6400 key level as resistance. A break above would signal a bullish reversal. On the other hand, if bears remain in the lead, the price will bounce lower to continue the downtrend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.