The Australian Bureau of Statistics (ABS) showed Australia’s headline inflation rising by 2.3% in the 12 months to November, up from October’s 2.1% reading, with underlying inflation measures signaling persistent price pressures.

Excluding volatile items and holiday travel, consumer prices rose by 2.8% in November, accelerating from 2.4% in October.

Meanwhile, Reserve Bank of Australia’s (RBA) trimmed mean inflation – an alternative measure of core inflation – came in at 3.2% in November, down from 3.5% in October but still above the central bank’s 2% – 3% target band.

Link to ABS November CPI Report

Details also revealed that:

- Food and non-alcoholic beverages (+2.9%), Alcohol and tobacco (+6.7%), and Recreation and culture (+3.2%) saw the most significant gains

- Electricity (-21.5%) and Transport (-2.4%) helped offset overall prices

- Housing costs remained elevated with Rents up 6.6% year-over-year

November’s inflation readings, while showing some moderation in core measures, suggest the RBA still faces challenges in bringing inflation sustainably back to target.

However, the growing rate differential with the U.S. and increasing expectations of earlier rate cuts are likely to keep pressure on the Australian dollar in the near term.

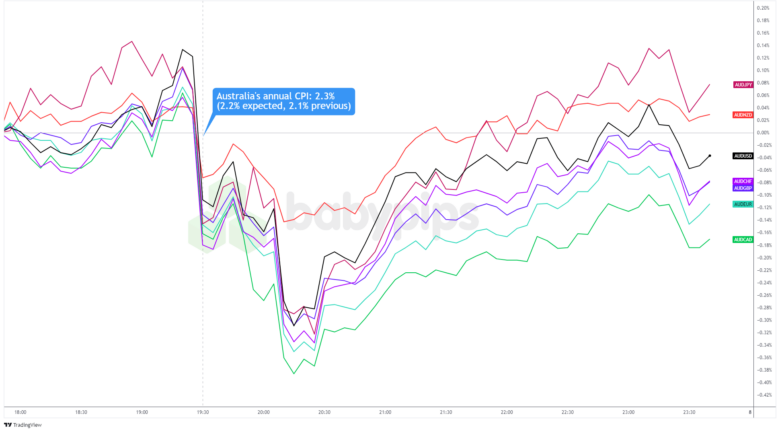

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

The Australian dollar, which had been clawing back some of its losses from the U.S. session, took a sharp dive after the CPI data dropped.

AUD’s reaction shows traders are leaning harder into the idea of earlier RBA rate cuts, even though core inflation is still pretty sticky. Traders are now pricing in a 61% chance of an RBA rate cut in February, up from 51% before the numbers came out. Rates are expected to slide to about 3.57% by the end of the year, while U.S. rates are looking to peak closer to 3.95%.

The yield spread isn’t doing the Aussie any favors either. Aussie bonds are paying less than U.S. Treasuries now, a big shift from a couple of months back. That flip in yield advantage has been another weight dragging down the Aussie.

Despite these, AUD started recovering about an hour after the CPI release, likely as risk sentiment improved and traders turned optimistic about China’s potential stimulus announcements. As of writing, AUD is trading just under its pre-CPI levels against its major counterparts.