A WeWork co-working office space in New York, US, on Tuesday, Nov. 7, 2023.

Yuki Iwamura | Bloomberg | Getty Images

WeWork, the shared office space company once valued at $47 billion, emerged from bankruptcy on Tuesday and named Cushman & Wakefield executive John Santora as its new CEO.

WeWork filed for Chapter 11 bankruptcy protection in November, with total liabilities of $18.65 billion against assets of $15.06 billion. The Covid-19 pandemic, which led to a surge in vacancies, coupled with an economic slump and steep downturn in tech valuations, contributed to WeWork’s troubles.

Santora becomes WeWork’s fourth permanent CEO in five years after the company’s failed initial public offering in 2019 and subsequent restructuring. He replaces David Tolley, who began service as interim CEO in May 2023 before assuming the permanent role in October. The announcement comes more than a week after WeWork’s target exit date of May 31. WeWork also announced a new board, including Anant Yardi, CEO of property management software company Yardi Systems.

During Tolley’s brief tenure, WeWork entered bankruptcy protection. The company has since renegotiated more than 190 leases and exited more than 170 “unprofitable” locations, according to a company release.

Santora previously served as Cushman & Wakefield‘s Tri-State chairman and leaves the commercial real estate firm after 40 years.

The downsizing of WeWork’s real estate portfolio reduced annual rent and tenancy expenses by more than $800 million, and the company also secured $400 million of additional equity capital. WeWork said last week that its portfolio now includes about 45 million square feet in 600 locations across 37 countries.

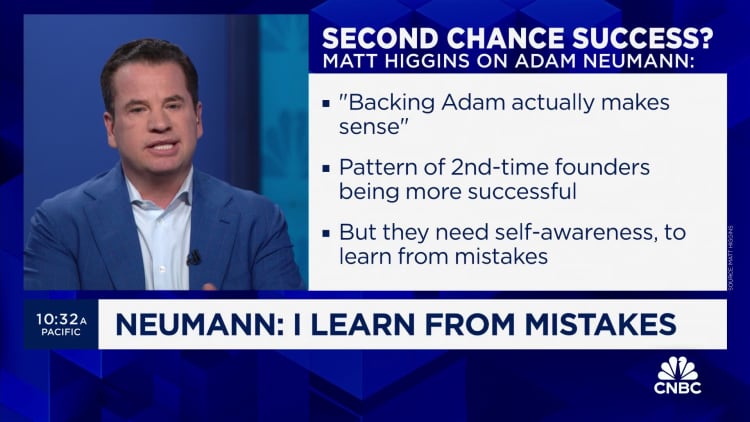

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey. Neumann led the company through years of historic growth and massive financing rounds. He was ousted in 2019 soon after WeWork’s IPO prospectus was released. The company eventually went public in 2021 through a special purpose acquisition company (SPAC), before equity holders were wiped out two years later.