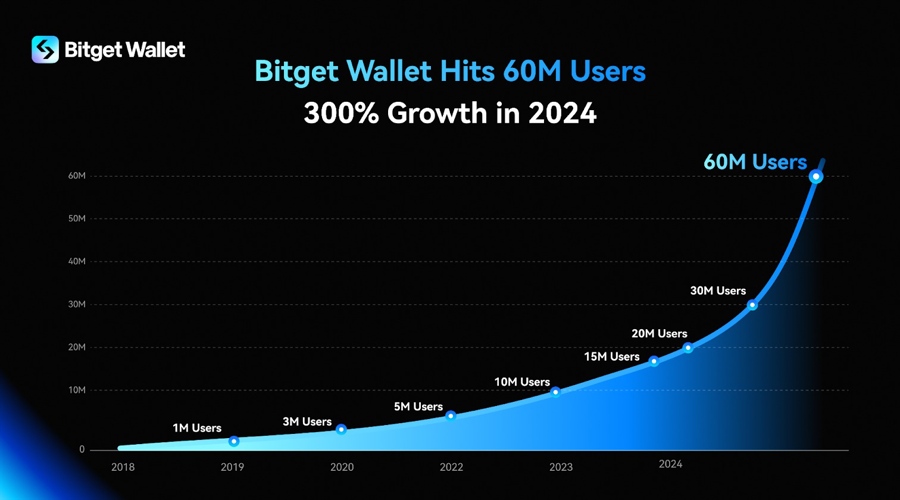

The non-custodial crypto wallet provided by the Bitget exchange reported that its user base exceeded

60 million globally in 2024. According to the company’s year-end report, this represents a 300% increase from the previous

year.

Bitget Wallet Reports 300% User Growth amid Digital Asset Expansion

Bitget

Wallet documented significant regional variations in user adoption. African

markets demonstrated the highest percentage gains, with Nigeria recording a

1,468% increase in users. The broader African continent saw growth exceeding

1,000% compared to the previous year.

“Our

vision is to build a superapp that seamlessly connects Web2 and Web3, enabling

a billion users to embrace financial freedom,” said Alvin

Kan, COO of Bitget Wallet. “We are committed to leading this

transformation and becoming the definitive bridge between the real world and

the onchain economy.”

In the

Middle Eastern markets, Saudi Arabia registered 482% user growth while the

United Arab Emirates showed a 326% increase. European markets also exhibited

substantial expansion, with France recording 1,091% growth, followed by the

United Kingdom at 687% and Germany at 657%.

The

platform’s data indicates distinct regional patterns in trading behavior. DeFi

token trading averaged $3,312 in annual volume per user. Its highest activity is concentrated in East Asia, the Middle East, and the Americas. Meme token

trading volumes averaged $1,337 per user annually, with the Middle East,

Europe, and East Asia showing the most significant activity.

Within two

months, Bitget Wallet expanded its user base by

20 million. For comparison, at the beginning of 2019, the platform had

“only” 1 million users.

This new

milestone coincided with an all-time high for the exchange‘s utility

token, BGB, which tested the $8.5 level, marking a 1000% increase in 2024.

2024 Recap

The

company’s integration with Telegram’s ecosystem resulted in the launch of

Bitget Wallet Lite, which accumulated 10 million users within its initial

month. To support further development, the company allocated $20 million toward

a Telegram Mini-App Support Program and introduced the OmniConnect Dev Kit.

The first

quarter of 2024 saw the introduction of the Bitget Onchain Layer. Subsequently,

the company consolidated its token structure, merging its platform token BWB

with BGB tokens. The unified BGB token now facilitates multi-chain gas payments

and staking operations.

Data from

the platform indicates increased blockchain adoption across multiple networks.

User addresses on TON, Base, and Solana networks showed fortyfold

year-over-year growth. The platform currently maintains connections with over

100 blockchains and facilitates access to approximately 20,000 decentralized

applications.

Forward Strategy

For 2025,

the company outlined plans to expand its services in on-chain financial

operations, focusing on trading execution and digital asset management.

Additional development priorities include streamlining crypto payment systems

and implementing simplified fiat-to-crypto conversion processes.

This article was written by Damian Chmiel at www.financemagnates.com.

Source link