Escalated risks surrounding Russia’s revised nuclear doctrine and U.S.-Ukraine relations are driving risk-averse sentiment, particularly in European markets.

Key Points

- Nvidia’s Q3 report takes center stage, impacting tech and AI sectors.

- The Trump administration’s fiscal policies could reshape inflation and interest rate outlook.

- Gold and silver rise as geopolitical concerns drive safe-haven demand.

Market Overview

Global markets witnessed mixed trends on Tuesday as investors balanced geopolitical tensions, corporate earnings anticipation, and potential policy shifts in the United States. U.S. equities were primarily influenced by expectations surrounding Nvidia’s earnings report and the broader implications of the incoming White House administration. Meanwhile, geopolitical risks, including escalated tensions between Russia and the U.S., weighed heavily on European and Asian markets.

The U.S. 10-year Treasury yield eased to 4.373%, reflecting cautious optimism over inflation and interest rate trajectory as markets speculate on fiscal policies under President-elect Donald Trump. Notable gains in the technology sector buoyed the Nasdaq and S&P 500, while the Dow Jones struggled, weighed down by losses in energy and financial sectors.

In commodities, Brent crude and WTI crude oil saw slight dips amid concerns over rising U.S.-Russia tensions. Gold and silver strengthened as safe-haven assets gained favor in the risk-averse environment.

Read More: What Trump’s Win Means For The Markets

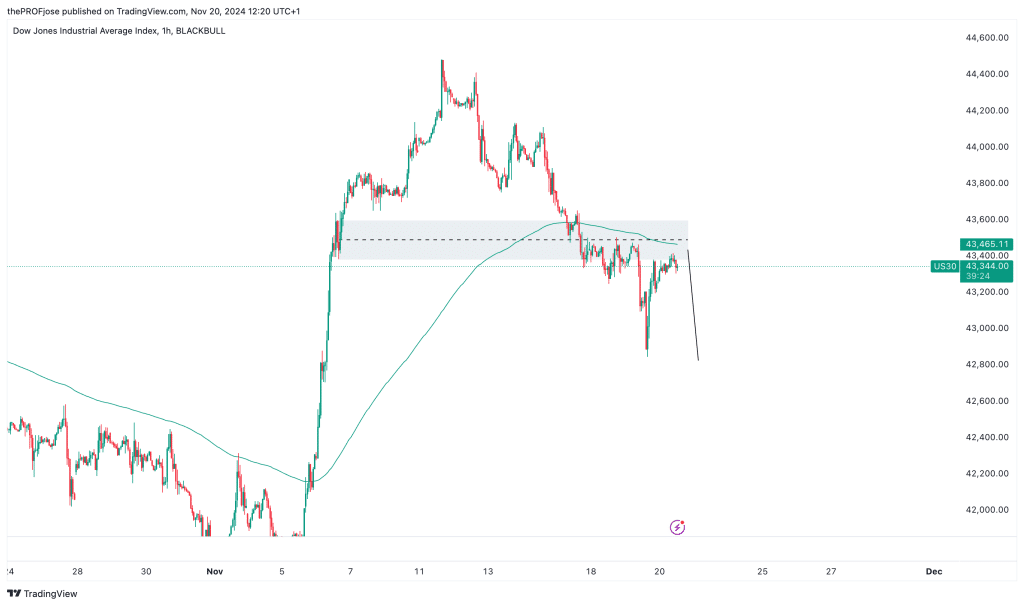

Dow Jones Prediction

The Dow Jones Industrial Average closed lower on Tuesday, dropping 0.40% to 43,217.01, marking its fifth decline in six sessions. Losses were driven by weaker performances in the energy and financial sectors, overshadowing gains in consumer staples. Walmart’s strong fiscal Q3 results were a bright spot, with its shares rising 3%, though this was insufficient to lift the broader index.

Investors continue to weigh the potential impact of the Trump administration’s proposed fiscal policies, including tax cuts and regulatory rollbacks. While such measures could bolster corporate profitability, uncertainty surrounding Congress’s stance on these initiatives has led to cautious positioning in the market.

Geopolitical risks also weighed on sentiment, with news of Russia revising its nuclear doctrine and the Biden administration permitting Ukraine to use advanced U.S. weaponry. These developments heightened global tensions, prompting a risk-off sentiment among equity traders.

The Dow’s performance will likely remain volatile in the short term as markets assess the Trump administration’s fiscal agenda, geopolitical risks, and upcoming macroeconomic data, including housing and inflation figures. The index may return to its downward momentum as price seems to respect key resistance levels.

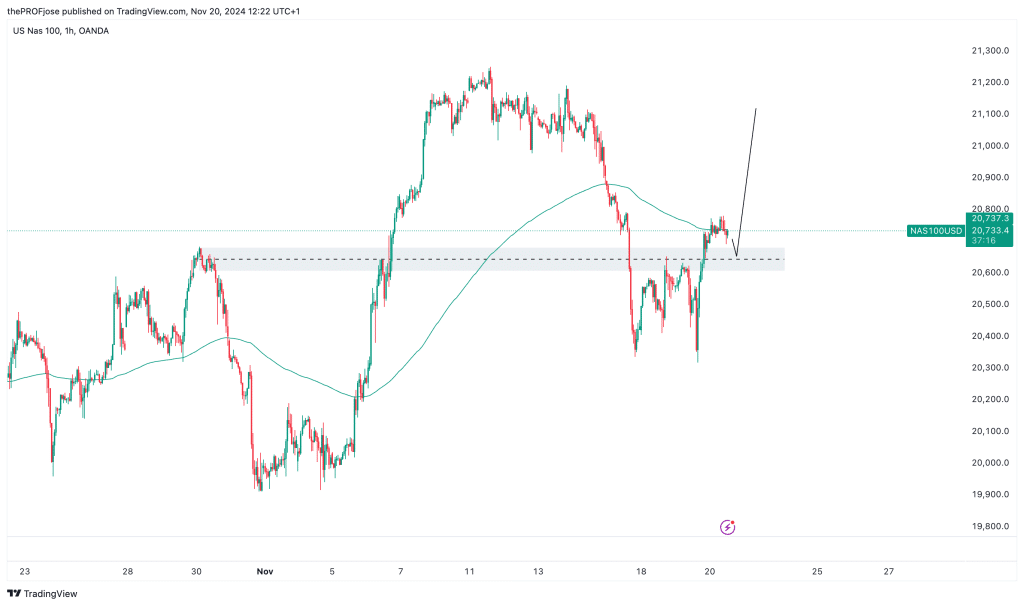

NASDAQ Prediction

The Nasdaq Composite outperformed its peers, rising 0.38% to 18,863.40, driven by strong performances in technology and artificial intelligence stocks. Nvidia’s pre-earnings rally boosted sentiment, alongside a 31% surge in Super Micro Computer shares, following positive developments on compliance and market confidence in its AI-focused product offerings.

Despite geopolitical headwinds, the tech-heavy Nasdaq remained resilient, underscoring investor optimism about the sector’s growth potential amid advancements in AI and cloud computing. The index’s gains were further supported by subdued bond yields, which typically favor growth stocks.

Bitcoin’s rally above $94,000 added to the bullish sentiment for technology and speculative assets as expectations grow for a crypto-friendly stance from the incoming Trump administration.

The Nasdaq is poised for continued strength if Nvidia delivers solid earnings and guidance. However, broader market volatility stemming from geopolitical risks and inflation concerns could temper gains.

Investors will also watch closely for updates on Federal Reserve policy and macroeconomic data that could influence tech sector valuations.

S&P 500 Prediction

The S&P 500 edged higher, closing up 0.03% at 5,895.43 on Tuesday. Gains in technology stocks, led by Nvidia and Super Micro Computer, offset losses in materials, energy, and healthcare sectors. Nvidia’s 4.9% surge ahead of its earnings report bolstered the broader tech sector, which remains a key driver of the index’s resilience amid economic uncertainty.

Retail giant Walmart provided additional support, raising its full-year outlook following better-than-expected Q3 results. Conversely, Lowe’s shares dropped 4.6% despite improved guidance, as weaker demand for discretionary home improvement projects weighed on sentiment.

Investors are positioning for the Federal Reserve’s next moves on interest rates amid mixed economic signals. The Fed is expected to maintain a cautious approach, balancing inflation concerns against geopolitical and economic risks.

With Nvidia’s earnings expected to set the tone for tech-heavy sectors, the S&P 500 could see further gains if the report beats expectations. However, geopolitical tensions and inflationary pressures remain downside risks. Key data, including U.S. housing starts and inflation metrics, will be closely monitored.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn’t suitable for everyone.