- Trump’s win has changed the outlook for the economy and inflation.

- Data on US inflation revealed that price pressures increased as expected.

- US sales jumped more than expected.

The USD/CAD weekly forecast remains bright, with the US dollar scaling a one-year high on Trump’s policy proposals.

Ups and downs of USD/CAD

The loonie had a bullish week as the dollar soared to a one-year high against its peers on Trump optimism. Market participants continued absorbing the recent US election outcome, which boosted the US dollar. Trump’s win has changed the outlook for the economy and inflation. Experts believe the economy will grow rapidly, and inflation will spike. Therefore, the Fed might pause its rate cuts.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Meanwhile, data on inflation revealed that price pressures increased as expected. However, rate-cut bets dropped sharply after Powell said there was no hurry to lower borrowing costs. Other data showed that sales jumped more than expected, indicating robust consumer spending.

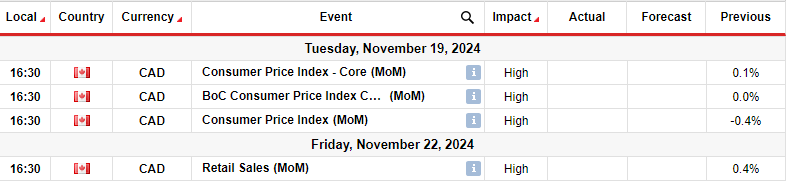

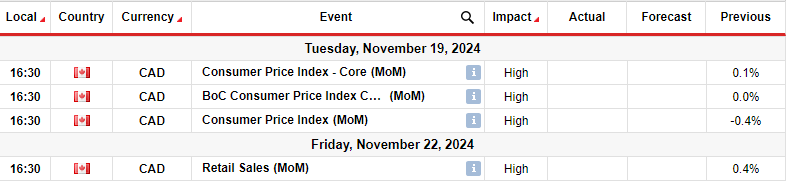

Next week’s key events for USD/CAD

Next week, Canada will release key figures on inflation and retail sales that will shape the outlook for Bank of Canada rate cuts. Inflation in Canada has eased significantly and is now at 1.6%, within the central bank’s target. As a result, the Bank of Canada is more focused on preserving growth, which has deteriorated.

Still, the low inflation is also piling pressure on policymakers to lower borrowing costs. Market participants are already pricing more aggressive BoC rate cuts. Therefore, cooler-than-expected figures will weigh on the Canadian dollar.

Meanwhile, the retail sales report will show the health of the consumer and the economy at large, further shaping the outlook for rate cuts.

USD/CAD weekly technical forecast: Bearish RSI divergence

On the technical side, the USD/CAD price has made a new high after respecting the 22-SMA as support. The price trades far above the SMA, indicating a solid bullish bias. At the same time, the RSI trades in the overbought region, suggesting strong bullish momentum.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

The price recently broke above the 1.3951 resistance level and rose to make a new high near the 1.4101 key level. However, while the price made a higher high, the RSI made a lower one, indicating weaker bullish momentum. Therefore, next week, USD/CAD might pull back next week to retest the 1.3951 support or the 22-SMA line. Nevertheless, the bullish trend will continue if the price stays above the SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money