- Australia’s central bank kept rates unchanged, maintaining its cautious tone.

- Trump’s win was bullish for the dollar as his policies could increase inflation and interest rates.

- The US Central Bank lowered interest rates by 25-bps.

The AUD/USD weekly forecast suggests expectations for higher US inflation that might keep the dollar strong. Meanwhile, Trump’s victory already pushes dollar up.

Ups and downs of AUD/USD

The Aussie fluctuated this week but ended down as the dollar gained after Trump’s presidential win. The week started with the Reserve Bank of Australia policy meeting. The central bank kept rates unchanged, maintaining its cautious tone.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

After that, the US election took the spotlight. Trump’s win was bullish for the dollar as his policies could increase inflation and interest rates. The last significant event was the FOMC policy meeting, where the US central bank lowered interest rates by 25-bps.

Next week’s key events for AUD/USD

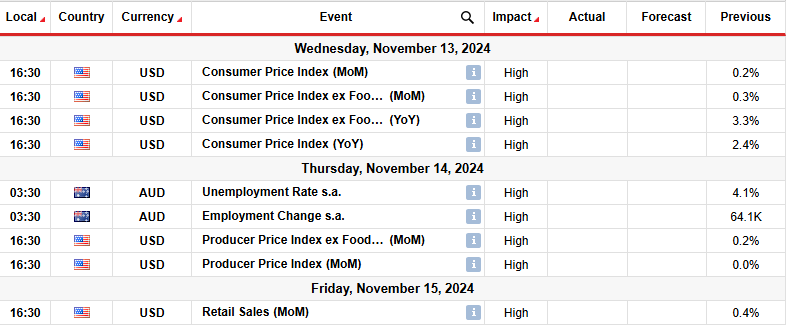

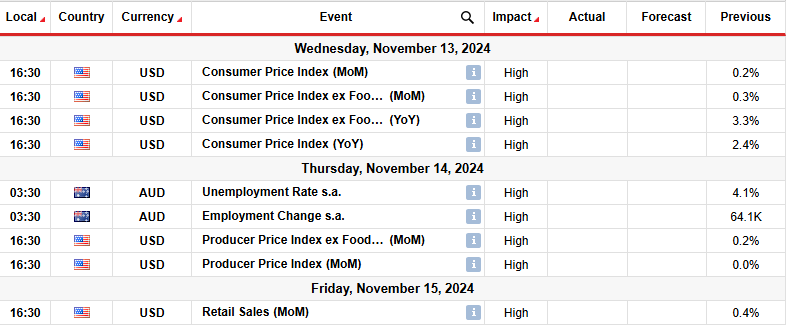

Next week, market participants will focus on US inflation and retail sales data. Meanwhile, Australia will release data showing the country’s employment situation. Economists expect US consumer inflation to hold at 0.2%. Similarly, core consumer inflation will likely increase by 0.3%, mirroring the previous month’s increase.

A bigger-than-expected increase in inflation will lower expectations for a Fed rate cut in December, boosting the dollar. On the other hand, if inflation is soft, it will solidify bets for a December rate cut.

Meanwhile, Australia’s labor market has remained robust, keeping the RBA cautious about rate cuts. Another blockbuster report will support the Aussie and push back bets for the first RBA rate cut.

AUD/USD weekly technical forecast: Downtrend holds firm, with next target at 0.6501

On the technical side, the AUD/USD price punctured a key resistance zone but failed to sustain a move higher. The price recently shifted from an uptrend to a downtrend when bears made a lower low below the 0.6650 key level. Afterward, bulls tried to take back control by breaking above the 0.6650 level and the 22-SMA. However, the price swiftly reversed as bearish momentum surged.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

If bears remain in control next week, the price will likely retest the 0.6501 support level. A break below this level would solidify the bearish bias as the price would make a lower low. Another support level to watch is 0.6350. On the other hand, bulls might make another attempt at the 22-SMA. A break above would indicate a shift in sentiment to bullish.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.