Australian

CFD brokers are bracing for significant changes to their reporting obligations

as the Australian Securities and Investments Commission (ASIC) finalizes its

“ASIC Rewrite” of OTC derivative reporting rules, set to commence today

(Monday).

CFD Brokers Face New

Reporting Requirements as ASIC Rewrite Looms

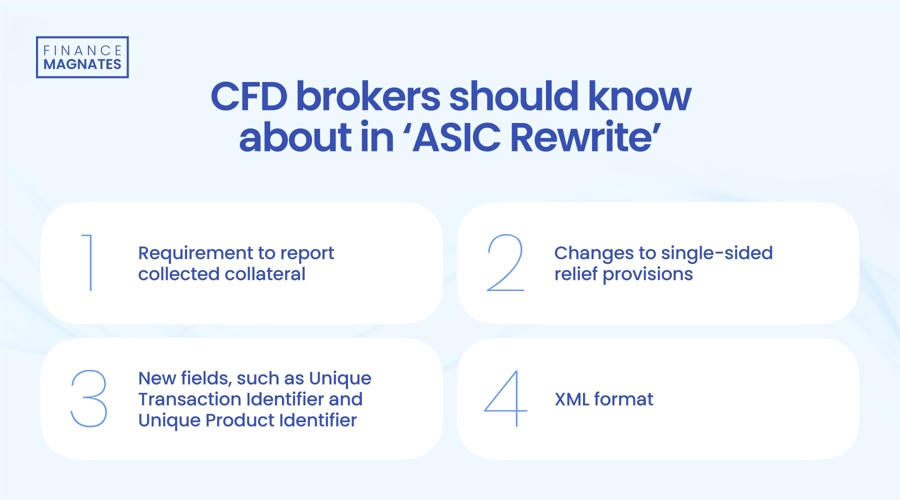

The new

rules, which have been years in the making, will introduce sweeping changes to

how CFD brokers report transactions and manage client data. Key updates include

the requirement to report collected collateral, new unique identifier fields,

and a shift to XML formatting.

What is changing for CFD

brokers?

- Expanded

collateral reporting:

Brokers must now report margin received from clients, not just margin posted to

hedging counterparties. This provides regulators with a more comprehensive view

of collateral flows. - Revised

single-sided reporting rules: The framework for single-sided reporting relief has been updated,

potentially affecting how some trades are reported. - New

identifier fields:

The introduction of Unique Transaction Identifiers (UTIs) and Unique Product

Identifiers (UPIs) aims to improve trade matching and product classification

across the industry. - Standardized

data format:

Reports must now be submitted in XML format, promoting consistency and easier

data processing.

“The

ASIC Rewrite will bring many major and minor reporting changes for CFDs brokers,”

said Sophie Gerber, co-CEO of TRAction Fintech. “Previously, reporting

entities (such as CFD brokers) only had to report collateral that was ‘posted.’

Now, they will also have to report collateral received.”

Gerber

highlighted that the implementation is staggered, with the bulk of changes

coming into effect now, followed by additional requirements in October 2025:

- 21

October 2024 – UPI, UTI, XML format, and the

country of counterparty 2. - 20

October 2025 –

Removing the “alternative reporting” framework, requiring ASIC-regulated firms

to report trades with foreign firms, regardless of the foreign firm’s reporting

obligations. Reporting must be submitted to ASIC-authorized repositories to

qualify for compliance relief.

“CFD

brokers should consider the changes, particularly the impact of the additional

requirement to report collected collateral in relation to derivatives on behalf

of their clients,” Gerber advised. “Whether this will be strenuous on

the business and require additional resourcing, along with the timing of the

two implementation dates, should be carefully considered.”

What are UTIs and UPIs?

The ASIC

Rewrite introduces new concepts such as Unique Transaction Identifiers (UTIs)

and Unique Product Identifiers (UPIs), aligning Australian reporting standards

more closely with global practices.

UTIs

UTIs are

like unique barcodes for individual derivatives transactions. They allow

regulators and market participants to identify and track specific trades across

different systems and institutions. UTIs help prevent double-counting of trades

and make it easier to reconcile trade data. When a derivatives trade is

executed, it is assigned a UTI – typically a long alphanumeric code. This UTI

stays with the trade throughout its lifecycle, allowing it to be tracked even

if it is modified or transferred between parties.

UPIs

UPIs are

standardized codes that identify specific types of derivatives products. They

provide a consistent way to classify and identify the particular product being

traded, such as a certain type of interest rate swap or credit default swap.

UPIs are

typically shorter codes that represent the key characteristics of a derivatives

product. By using UPIs, regulators and market participants can more easily

analyze market activity and risk across comparable products, even when those

products are traded on different platforms or in different jurisdictions.

To Sum Up

UTIs

identify specific trades, while UPIs identify what type of product was traded.

Together, these identifiers help create a more organized and transparent

derivatives market by providing consistent ways to label and track trades and

products across different institutions and jurisdictions.

As the

October 2024 deadline approached, ASIC

provided further guidance to help firms transition to the new reporting

regime.

This article was written by Damian Chmiel at www.financemagnates.com.

Source link