Deutsche Bank have a research note out outlining that easing expectations for the Federal Reserve are still too aggressive.

- around 200bps of cuts priced in, including the 50bps we’ve already seen.

- if

the economy is in decent shape, a sizeable easing cycle surely

increases inflation all other things being equal

The note argues that it’s not only the Fed’s 50 basis points rate cut that has altered the outlook for inflation and interest rates recently. We’ve also observed:

- rising expectations of more aggressive action from the ECB;

- increased geopolitical risks and the potential for significant stimulus from China, driving oil and other commodity prices higher after a summer dip;

- a strong payrolls report;

- generally solid US economic data, including an unexpected increase in last week’s CPI

And conclude

- This

is not to say inflation is out of control but the narrative of a strong

economy, a relatively aggressive Fed easing cycle and perfectly behaved

inflation sounds more like a Christmas wish list rather than the most

likely outcome. One or two of them can easily materialise but to get all

three is going to be tough.

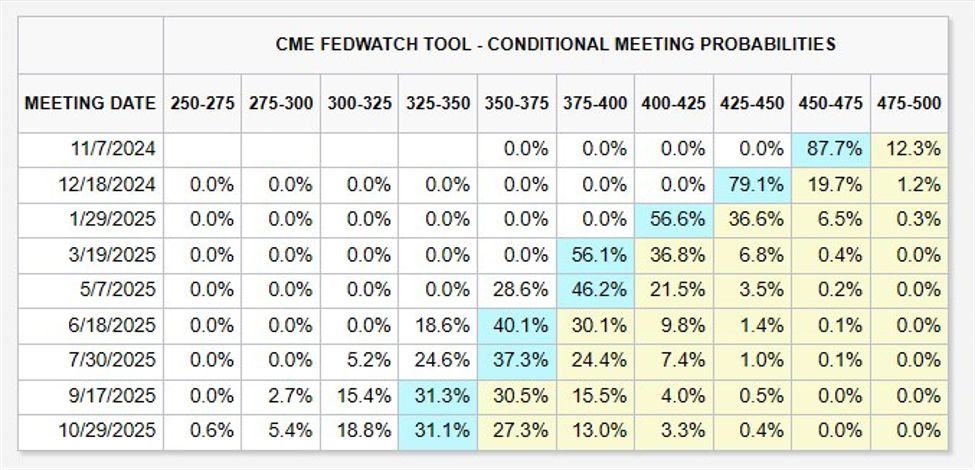

Via FedWatch tool:

The current rate is 4.75 – 5.00%

–

As a ps, I think DB is on the right track.