In the long-running battle between stocks and bonds, the latter is usually right when it comes to the economy. Given that oil and the yen are also flagging trouble, the signs are hard to ignore.

In early August, when US yields fell, it looked like a reaction to a flight-to-safety as some air came out of the AI trade and megacap tech stocks but when those rebounded, yields didn’t. Now they’ve fallen even further and signal a hasty Fed rate cutting cycle. Now Powell may front-load rate cuts in an effort to stick a soft landing but that path is perilous.

In addition, there is the global economy to worry about and the signals from oil and other commodities are poor. Brent and WTI today settled at the lowest since 2021, iron ore has plunged lately and copper is back to $4/lb.

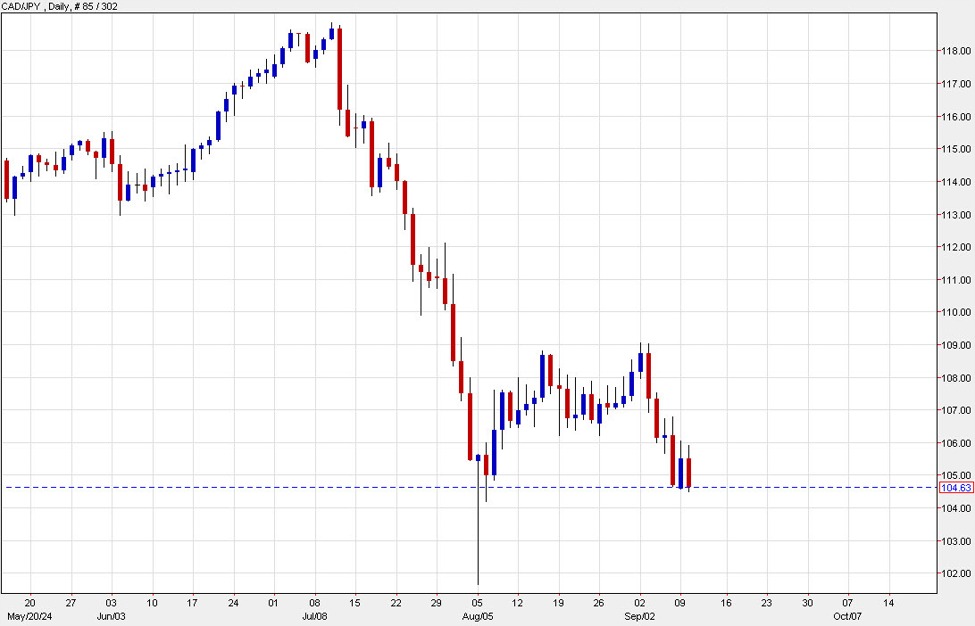

Finally, the yen carry trade isn’t showing any signs of recovery after the battering in August. If anything, the growth-sensitive trades are flagging the risk of another leg lower.

CADJPY daily

Later this month, I will be hosting a webinar or signals of trouble in the global economy and where to camp out. I’m looking forward to it. Register here.