The Canadian dollar is the weakest performer today and if you read between the lines in Tiff Macklem’s comments, the Bank of Canada is trying to put the possibility of a 50 basis point cut in October on the table, particularly if upcoming GDP reports highlight ongoing weakness.

A big reason that they need to cut fast is that the housing pipeline is drying up. There are still 20,000 condos to be completed in Toronto alone in the next two years but single family starts and townhouses are stalling at a time when there is extreme pressure to improve affodability.

Given Canada’s construction productivity problems, the outlook isn’t good. The alternative is that growing anti-immigration sentiment catalyzes into a place that’s irreversible, leading to a population undershoot. That could lead to a secular stagnation in the economy, particularly if the global economy doesn’t improve.

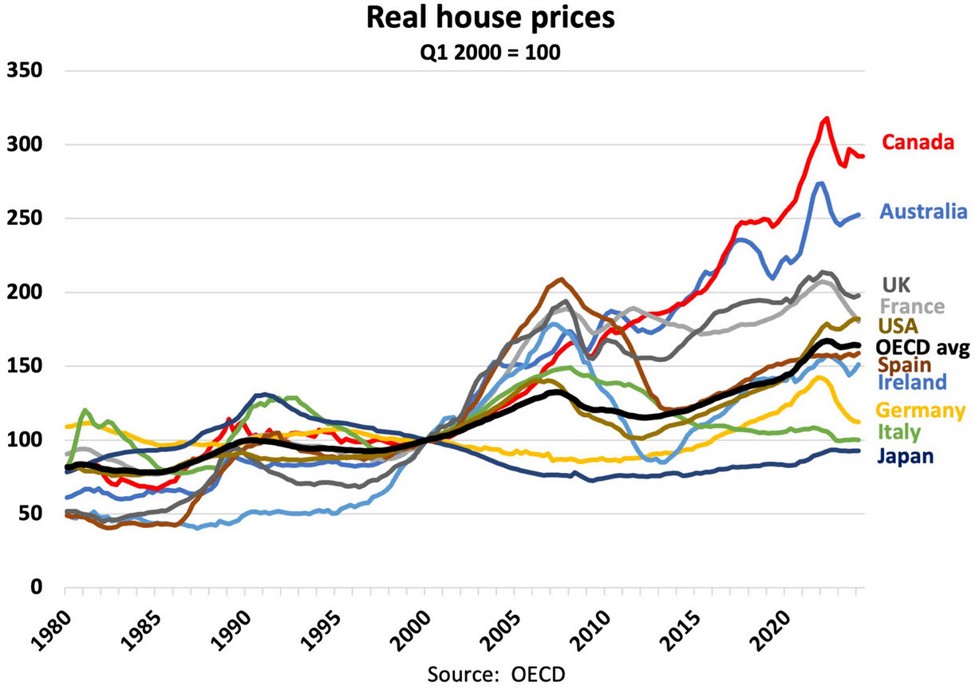

The fear for many is that Canada re-inflates the housing bubble.

chart from @BenRabidoux

Ultimately, I think it will be impossible to fix Canada’s problems with high, or even medium interest rates. For me, all roads lead back into the sub-2% range and structurally lower rates than the US. With that, the relief valve will be the currency.

The risk from that is that Canada imports inflation and rates will need to rise again but I think there is enough slack building in the jobs market and global economy that Canada will keep rates low.