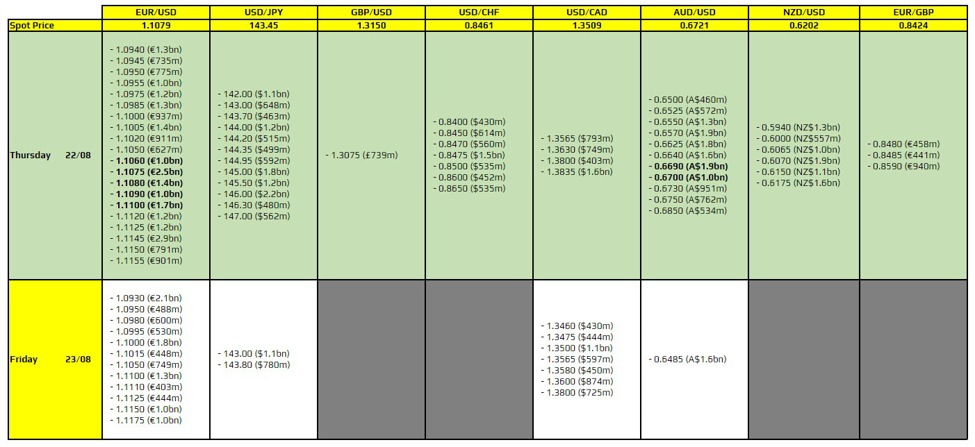

There are quite a number to take note of on the day, as highlighted in bold.

The first ones are for EUR/USD and they are layered between 1.1060 through to 1.1100. The expiries are likely to help keep price action more contained in the session ahead, at least until we get to key US data later on. After that, it’s pretty much a case of anything goes in markets.

Similarly, the ones for AUD/USD at 0.6690 and 0.6700 are to keep any overextension to the downside until we get to the slew of US data releases later in the day.

In that lieu, it’s a reminder that we will be getting the US ADP employment change, weekly initial jobless claims, and ISM services PMI. All of that put together will make for very data-driven sentiment in trading before the non-farm payrolls tomorrow.

For more information on how to use this data, you may refer to this post here.