Wall Street

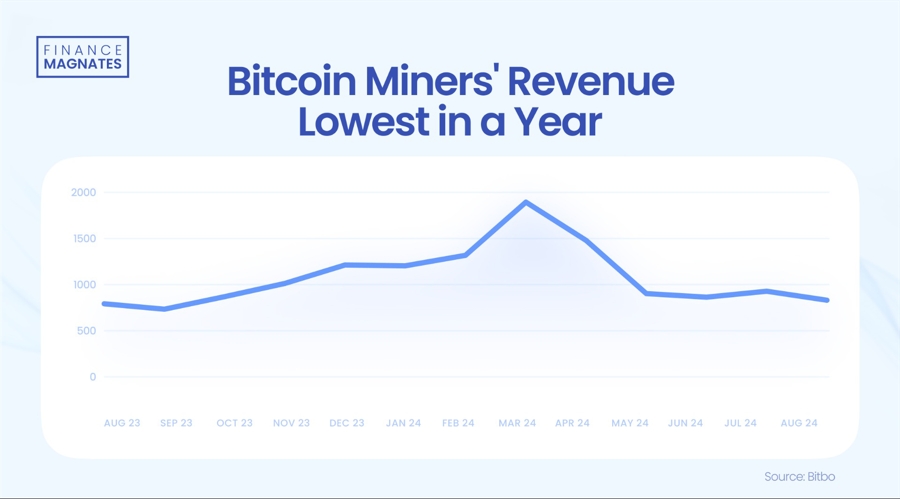

Bitcoin (BTC) miners faced their toughest month of the year in August, with

revenues plummeting to levels not seen since September 2023. The downturn

highlights the growing challenges in the cryptocurrency mining sector, as

increased competition and technical hurdles continue to squeeze profit margins.

According

to data from analytics

firm Bitbo, miners’ revenue for August totaled $827.56 million,

marking a significant 10.5% decrease from July’s $927.35 million. This figure

represents a staggering 57% drop from the 2024 peak of $1.93 billion recorded

in March, coinciding with Bitcoin’s all-time high of over $73,500.

Source: Bitbo

The decline

in revenue comes despite Bitcoin ‘s current trading price of $57,315, more than

double its value from the previous low-revenue period in September 2023.

Industry experts attribute this paradox to a combination of factors, including

reduced transaction volumes and a substantial increase in mining difficulty.

Fred Thiel, CEO, MARA, Source: LinkedIn

“During the

second quarter of 2024, our BTC production was impacted by unexpected equipment

failures and transmission line maintenance at the Ellendale site operated by

Applied Digital, increased global hash rate, and the April halving event,” said

Fred Thiel, CEO of publicly traded miner Marathon Digital Holdings. The

company’s revenue for the second quarter was

$145.1 million, missing the FactSet estimate of $157.9 million.

August saw

mining difficulty reach an all-time high of 89.47 trillion, up from 86.87

trillion in July. This increase in difficulty, coupled with a slight drop in

the number of mined Bitcoins from 14,725 in July to 13,843, has

created a perfect storm for miners.

Transaction

fees, which typically provide a buffer against reduced block rewards, have also

failed to compensate for the shortfall. The median fees made up just 2% of

block rewards in August, while daily confirmed transactions averaged 594,871 by

the end of the month, down from a peak of 631,648 on July 31.

HPC and AI as Alternative

Revenue Streams

In response

to these challenges, some miners are exploring alternative revenue streams.

Cindy Feng, Founder of BitcoinMiningStock.io, an analytics service with data on

publicly listed Bitcoin miners, points to the main direction being the support

of resource-intensive artificial intelligence (AI) and high-performance

computing (HPC).

“When

it comes to embracing HPC and AI hosting , a few miners stand out,” commented

Feng. Core Scientific (CORZ), Iris Energy (IREN), and Bit Digital (BTBT) have

been making headlines, while others like Hut 8 (HUT), TeraWulf (WULF), and

Bitdeer (BTDR) have been quieter on this front.

We also

wrote about this trend on Finance Magnates. According to an analysis by

VanEck’s head of digital assets research, Matthew Sigel, estimates that this

strategic pivot could unlock $38 billion in value for mining companies by 2027.

“AI

companies need energy, and Bitcoin miners have it,” commented

Sigel. “As the market values the growing AI/HPC data center market, access

to power—especially in the near term—is commanding a premium.”

Wall Street

Bitcoin (BTC) miners faced their toughest month of the year in August, with

revenues plummeting to levels not seen since September 2023. The downturn

highlights the growing challenges in the cryptocurrency mining sector, as

increased competition and technical hurdles continue to squeeze profit margins.

According

to data from analytics

firm Bitbo, miners’ revenue for August totaled $827.56 million,

marking a significant 10.5% decrease from July’s $927.35 million. This figure

represents a staggering 57% drop from the 2024 peak of $1.93 billion recorded

in March, coinciding with Bitcoin’s all-time high of over $73,500.

Source: Bitbo

The decline

in revenue comes despite Bitcoin ‘s current trading price of $57,315, more than

double its value from the previous low-revenue period in September 2023.

Industry experts attribute this paradox to a combination of factors, including

reduced transaction volumes and a substantial increase in mining difficulty.

Fred Thiel, CEO, MARA, Source: LinkedIn

“During the

second quarter of 2024, our BTC production was impacted by unexpected equipment

failures and transmission line maintenance at the Ellendale site operated by

Applied Digital, increased global hash rate, and the April halving event,” said

Fred Thiel, CEO of publicly traded miner Marathon Digital Holdings. The

company’s revenue for the second quarter was

$145.1 million, missing the FactSet estimate of $157.9 million.

August saw

mining difficulty reach an all-time high of 89.47 trillion, up from 86.87

trillion in July. This increase in difficulty, coupled with a slight drop in

the number of mined Bitcoins from 14,725 in July to 13,843, has

created a perfect storm for miners.

Transaction

fees, which typically provide a buffer against reduced block rewards, have also

failed to compensate for the shortfall. The median fees made up just 2% of

block rewards in August, while daily confirmed transactions averaged 594,871 by

the end of the month, down from a peak of 631,648 on July 31.

HPC and AI as Alternative

Revenue Streams

In response

to these challenges, some miners are exploring alternative revenue streams.

Cindy Feng, Founder of BitcoinMiningStock.io, an analytics service with data on

publicly listed Bitcoin miners, points to the main direction being the support

of resource-intensive artificial intelligence (AI) and high-performance

computing (HPC).

“When

it comes to embracing HPC and AI hosting , a few miners stand out,” commented

Feng. Core Scientific (CORZ), Iris Energy (IREN), and Bit Digital (BTBT) have

been making headlines, while others like Hut 8 (HUT), TeraWulf (WULF), and

Bitdeer (BTDR) have been quieter on this front.

We also

wrote about this trend on Finance Magnates. According to an analysis by

VanEck’s head of digital assets research, Matthew Sigel, estimates that this

strategic pivot could unlock $38 billion in value for mining companies by 2027.

“AI

companies need energy, and Bitcoin miners have it,” commented

Sigel. “As the market values the growing AI/HPC data center market, access

to power—especially in the near term—is commanding a premium.”