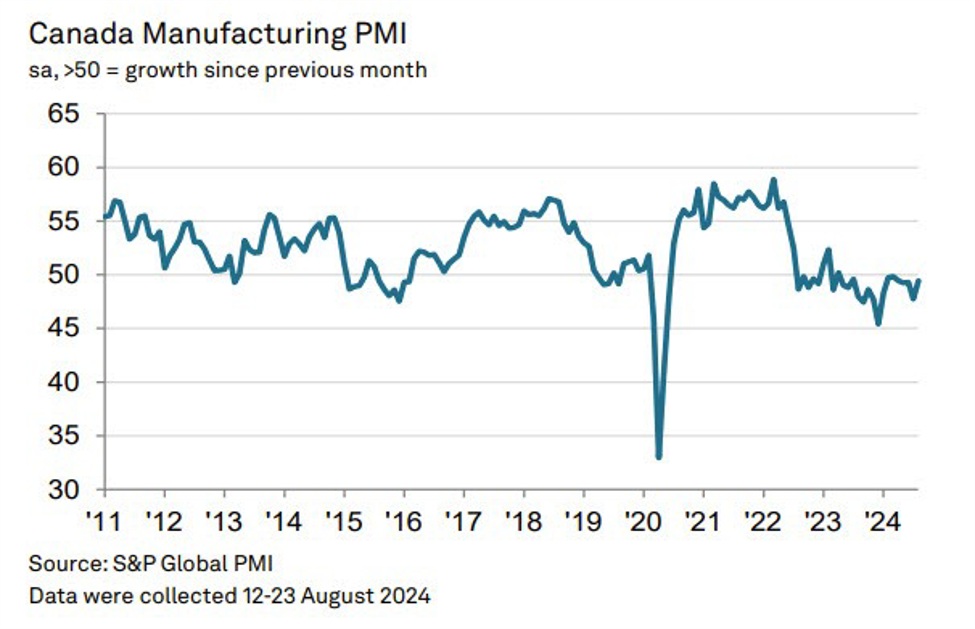

Canada S&P global PMI higher on the month

- Prior month 47.8

- S&P global manufacturing PMI for August 49.5 versus 47.8 last month

For the full report, CLICK HERE.

Below are the main points in bullet format:

Canada’s Manufacturing Economy:

-

Operating conditions continued to deteriorate in August, but at a marginal and softest degree since March.

-

Slower falls in output and new orders were reported.

-

Job shedding returned after marginal growth in July.

Challenges:

-

Shipping delays, especially ocean freight, led to vendor performance deterioration.

-

Input cost inflation accelerated to its sharpest since April 2023.

-

Output charges increased at the steepest rate in nine months.

Key Indicators:

-

S&P Global Canada Manufacturing PMI registered 49.5 in August, below the 50.0 no-change mark for the 16th successive month.

-

Weaker contractions in output and new orders were reported.

-

New export orders declined for the 12th successive month.

Employment and Sentiment:

-

Firms cut staffing levels due to reduced production requirements and hesitant clients.

-

Confidence in the outlook remained positive but below trend.

-

Concerns over demand impact from elevated prices and high interest rates persisted.

Price Pressures:

-

Input price inflation accelerated due to higher input prices, unfavourable exchange rate movements, and high shipping costs.

-

Manufacturers raised their charges to the greatest degree since last November.

Supply Chain:

-

Sea freight delays continued, with low inventories at suppliers.

-

Average lead times deteriorated to the greatest degree in 18 months.

-

Firms bolstered input stocks to mitigate risks, with input inventories rising modestly.

Commenting on the latest survey results, Paul Smith,

Economics Director at S&P Global Market Intelligence

said:

“Although the performance of Canada’s manufacturing

economy continues to disappoint, slower falls in output

and new orders point to a relatively better performance

in July than in August, thereby providing some hope

of the sector heading towards stabilisation after a

prolonged downturn. Still, reduced employment and cuts in purchasing

activity point to continued uncertainty amongst firms,

and this was reflected in their assessment of the

outlook, with confidence remaining below its trend level.

Firms continue to worry about price levels, and in this

regard the latest data on inflation remained concerning.

Cost pressures picked up to their highest in nearly a

year-and-a-half year, whilst output charge inflation

accelerated noticeably.”