Oracle chief technology officer Larry Ellison speaks at a company event in Redwood Shores, Calif., on Aug. 7, 2018.

Oracle livestream screenshot

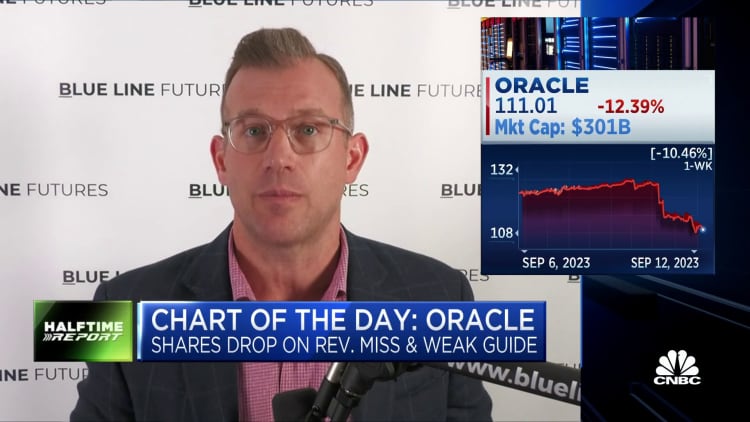

Oracle shares plummeted 12% on Tuesday, their steepest drop in over two decades, after the software maker reported disappointing revenue and issued weaker-than-expected guidance.

The last time the stock had a steeper percentage drop was a 15% decline in March 2002, at the tail end of the dot-com bust.

The plunge on Tuesday resulted in Oracle Chair Larry Ellison losing roughly $18 billion in wealth. Ellison is the world’s fourth-richest person, with a net worth of $140.6 billion, according to Forbes, just behind Amazon founder Jeff Bezos and ahead of Warren Buffett.

While Oracle’s earnings topped estimates, the company reported fiscal first-quarter revenue of $12.45 billion, falling short of the $12.47 billion average analyst estimate, according to LSEG. For the current quarter, Oracle said revenue will increase 5% to 7%, falling short of the 8% average analyst estimate.

Like big companies across the tech sector, Oracle has been selling investors on the benefits of artificial intelligence to its business. During the quarter, it added AI features in its Fusion Cloud and Human Capital Management Software, and Ellison said in the earnings statement that “as of today, AI development companies have signed contracts to purchase more than $4 billion of capacity in Oracle’s Gen2 Cloud,” double the amount it had booked at the end of the prior quarter.

However, analysts at Stifel wrote in a report after the results that “it is clear that investors were pricing in more AI and cloud-related upside.” The firm has a hold rating on the stock and a $120 price target.

Oracle CEO Safra Catz pointed to challenges at the company’s Cerner unit. In June of last year, Oracle closed the $28.2 billion purchase of the electronic health record software company, and now it’s in an “accelerated transition” to the cloud, Catz said.

“This transition is resulting in some near-term headwinds to the Cerner growth rate as customers move from licensed purchases, which are recognized upfront, to cloud subscriptions which are recognized ratably,” she said.

Revenue in Oracle’s cloud services and license support segment rose 13% from a year earlier, topping StreetAccount’s consensus of $9.44 billion. But sales in the cloud license and on-premises license segment fell 10% to $809 million, missing estimates.

Even with Tuesday’s stock drop, Oracle shares are up 34% year to date, beating the S&P 500, which is up 16%.

— CNBC’s Jordan Novet contributed to this report

WATCH: Oracle’s near-term volatility means investors should manage risk