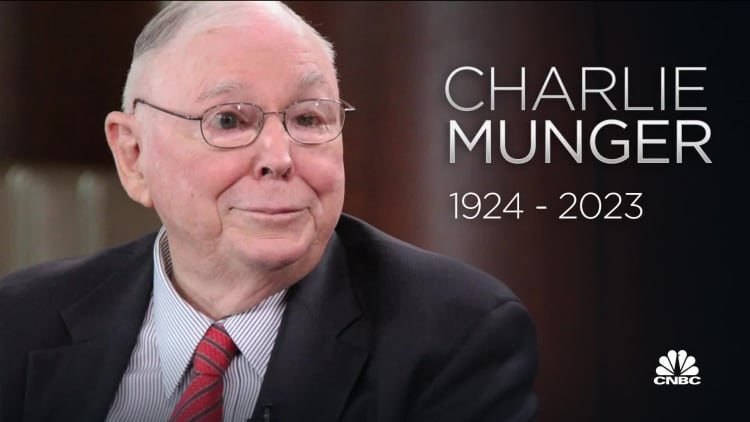

Billionaire Charlie Munger, the investing sage who made a fortune even before he became Warren Buffett’s right-hand man at Berkshire Hathaway, has died at age 99.

Munger died Tuesday, according to a press release from Berkshire Hathaway. The conglomerate said it was advised by members of Munger’s family that he peacefully died this morning at a California hospital. He would have turned 100 on New Year’s Day.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said in a statement.

In addition to being Berkshire vice chairman, Munger was a real estate attorney, chairman and publisher of the Daily Journal Corp., a member of the Costco board, a philanthropist and an architect.

In early 2023, his fortune was estimated at $2.3 billion — a jaw-dropping amount for many people but vastly smaller than Buffett’s unfathomable fortune, which is estimated at more than $100 billion.

During Berkshire’s 2021 annual shareholder meeting, the then-97-year-old Munger apparently inadvertently revealed a well-guarded secret: that Vice Chairman Greg Abel “will keep the culture” after the Buffett era.

Munger, who wore thick glasses, had lost his left eye after complications from cataract surgery in 1980.

Munger was chairman and CEO of Wesco Financial from 1984 to 2011, when Buffett‘s Berkshire purchased the remaining shares of the Pasadena, California-based insurance and investment company it did not own.

Buffett credited Munger with broadening his investment strategy from favoring troubled companies at low prices in hopes of getting a profit to focusing on higher-quality but underpriced companies.

An early example of the shift was illustrated in 1972 by Munger’s ability to persuade Buffett to sign off on Berkshire’s purchase of See’s Candies for $25 million even though the California candy maker had annual pretax earnings of only about $4 million. It has since produced more than $2 billion in sales for Berkshire.

“He weaned me away from the idea of buying very so-so companies at very cheap prices, knowing that there was some small profit in it, and looking for some really wonderful businesses that we could buy in fair prices,” Buffett told CNBC in May 2016.

Or as Munger put it at the 1998 Berkshire shareholder meeting: “It’s not that much fun to buy a business where you really hope this sucker liquidates before it goes broke.”

Munger was often the straight man to Buffett’s jovial commentaries. “I have nothing to add,” he would say after one of Buffett’s loquacious responses to questions at Berkshire annual meetings in Omaha, Nebraska. But like his friend and colleague, Munger was a font of wisdom in investing, and in life. And like one of his heroes, Benjamin Franklin, Munger’s insight didn’t lack humor.

“I have a friend who says the first rule of fishing is to fish where the fish are. The second rule of fishing is to never forget the first rule. We’ve gotten good at fishing where the fish are,” the then-93-year-old Munger told the thousands of people at Berkshire’s 2017 meeting.

He believed in what he called the “lollapalooza effect,” in which a confluence of factors merged to drive investment psychology.

A son of the heartland

Charles Thomas Munger was born in Omaha on Jan. 1, 1924. His father, Alfred, was a lawyer, and his mother, Florence “Toody,” was from an affluent family. Like Warren, Munger worked at Buffett’s grandfather’s grocery store as a youth, but the two future joined-at-the-hip partners didn’t meet until years later.

At 17, Munger left Omaha for the University of Michigan. Two years later, in 1943, he enlisted in the Army Air Corps, according to Janet Lowe’s 2003 biography “Damn Right!”

Read more about Charlie Munger’s legacy

The military sent him to the California Institute of Technology in Pasadena to study meteorology. In California, he fell in love with his sister’s roommate at Scripps College, Nancy Huggins, and married her in 1945. Although he never completed his undergraduate degree, Munger graduated magna cum laude from Harvard Law School in 1948, and the couple moved back to California, where he practiced real estate law. He founded the law firm Munger, Tolles & Olson in 1962 and focused on managing investments at the hedge fund Wheeler, Munger & Co., which he also founded that year.

“I’m proud of being an Omaha boy,” Munger said in a 2017 interview with Dean Scott Derue of the Michigan Ross Business School. “I sometimes use the old saying, ‘They got the boy out of Omaha but they never got Omaha out of the boy.’ All those old-fashioned values — family comes first; be in a position so that you can help others when troubles come; prudent, sensible; moral duty to be reasonable [is] more important than anything else — more important than being rich, more important than being important — an absolute moral duty.”

In California, he partnered with Franklin Otis Booth, a member of the founding family of the Los Angeles Times, in real estate. One of their early developments turned out to be a lucrative condo project on Booth’s grandfather’s property in Pasadena. (Booth, who died in 2008, had been introduced to Buffett by Munger in 1963 and became one of Berkshire’s largest investors.)

“I had five real estate projects,” Munger told Derue. “I did both side by side for a few years, and in a very few years, I had $3 million — $4 million.”

Munger closed the hedge fund in 1975. Three years later, he became vice chairman of Berkshire Hathaway.

‘We think so much alike that it’s spooky’

In 1959, at age 35, Munger returned to Omaha to close his late father’s legal practice. That’s when he was introduced to the then-29-year-old Buffett by one of Buffett’s investor clients. The two hit it off and stayed in contact despite living half a continent away from each other.

“We think so much alike that it’s spooky,” Buffett recalled in an interview with the Omaha World-Herald in 1977. “He’s as smart and as high-grade a guy as I’ve ever run into.”

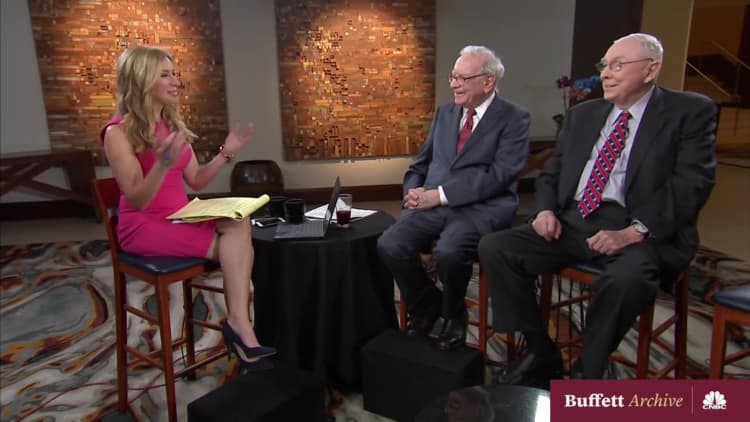

“We never had an argument in the entire time we’ve known each other, which is almost 60 years now,” Buffett told CNBC’s Becky Quick in 2018. “Charlie has given me the ultimate gift that a person can give to somebody else. He’s made me a better person than I would have otherwise been. … He’s given me a lot of good advice over time. … I’ve lived a better life because of Charlie.”

The melding of the minds focused on value investing, in which stocks are picked because their price appears to be undervalued based on the company’s long-term fundamentals.

“All intelligent investing is value investing — acquiring more than you are paying for,” Munger once said. “You must value the business in order to value the stock.”

Warren Buffett (L), CEO of Berkshire Hathaway, and vice chairman Charlie Munger attend the 2019 annual shareholders meeting in Omaha, Nebraska, May 3, 2019.

Johannes Eisele | AFP | Getty Images

But during the coronavirus outbreak in early 2020, when Berkshire suffered a massive $50 billion loss in the first quarter, Munger and Buffett were more conservative than they were during the Great Recession, when they invested in U.S. airlines and financials like Bank of America and Goldman Sachs hit hard by that downturn.

“Well, I would say basically we’re like the captain of a ship when the worst typhoon that’s ever happened comes,” Munger told The Wall Street Journal in April 2020. “We just want to get through the typhoon, and we’d rather come out of it with a whole lot of liquidity. We’re not playing, ‘Oh goody, goody, everything’s going to hell, let’s plunge 100% of the reserves’ [into buying businesses].”

The philanthropist/architect

Munger donated hundreds of millions of dollars to educational institutions, including the University of Michigan, Stanford University and Harvard Law School, often with the stipulation that the school accept his building designs, even though he was not formally trained as an architect.

At Los Angeles’ Harvard-Westlake prep school, where Munger had been a board member for decades, he ensured that the girls bathrooms were larger than the boys room during the construction of the science center in the 1990s.

“Any time you go to a football game or a function there’s a huge line outside the women’s bathroom. Who doesn’t know that they pee in a different way than the men?” Munger told The Wall Street Journal in 2019. “What kind of idiot would make the men’s bathroom and the women’s bathroom the same size? The answer is, a normal architect!”

Munger and his wife had three children, daughters Wendy and Molly, and son Teddy, who died of leukemia at age 9. The Mungers divorced in 1953.

Two years later, he married Nancy Barry, whom he met on a blind date at a chicken dinner restaurant. The couple had four children, Charles Jr., Emilie, Barry and Philip. He also was the stepfather to her two other sons, William Harold Borthwick and David Borthwick. The Mungers, who were married 54 years until her death in 2010, contributed $43.5 million to Stanford University to help build the Munger Graduate Residence, which houses 600 law and graduate students.

Asked by CNBC’s Quick in a February 2019 “Squawk Box” interview about the secret to a long and happy life, Munger said the answer “is easy, because it’s so simple.”

“You don’t have a lot of envy, you don’t have a lot of resentment, you don’t overspend your income, you stay cheerful in spite of your troubles. You deal with reliable people and you do what you’re supposed to do. And all these simple rules work so well to make your life better. And they’re so trite,” he said.

“And staying cheerful … because it’s a wise thing to do. Is that so hard? And can you be cheerful when you’re absolutely mired in deep hatred and resentment? Of course you can’t. So why would you take it on?”

— CNBC’s Yun Li contributed reporting.