Aussie Inflation Data Remains Mixed as Electricity Rebate Artificially Lowers CPI

Australian inflation rose at an annual pace of 3.5% in July, down from 3.8% in June according to the Australian Bureau of Statistics. The data point was slightly above the 3.4% estimate and while it looks encouraging at face value, much of the drop was due to rebates for the price of electricity which artificially lowered the CPI measure. While electricity and petrol prices eased on a monthly basis, rents, food and gas prices rose.

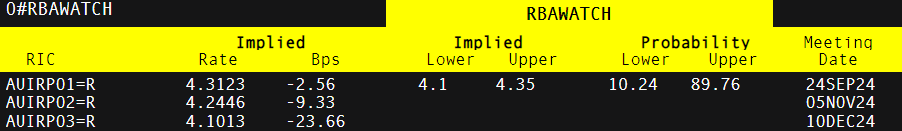

Markets have tempered earlier expectations of a possible rate cut in November and now see December as a much stronger possibility with markets pricing in a 72% chance of a 25-basis point cut.

Implied Basis Point Adjustments to the Policy Rate

Source: Refinitiv

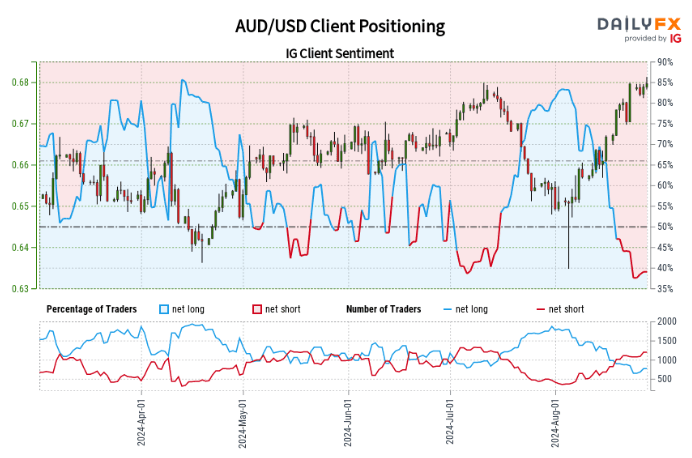

Data from retail traders indicates 40.75% are holding long positions, with the ratio of short to long traders at 1.45 to 1. Compared to yesterday, there’s a 2.06% increase in long positions, but a 9.60% decrease from last week. Short positions have decreased by 2.21% since yesterday but increased by 5.80% from last week.

Adopting a contrarian view typically opposes crowd sentiment. Given that traders are predominantly short, this suggests AUD/USD may continue to appreciate.

The current positioning shows a reduction in net-short positions compared to yesterday, but an increase from last week. This combination of present sentiment and recent shifts results in a mixed trading outlook for AUD/USD.

AUD/USD Daily Chart with Sentiment Overlay

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Improve your trading with IG Client Sentiment Data

BoJ Comments Reaffirm Hawkish Policy Stance

BoJ Deputy Governor Ryozo Himino addressed business leaders in Kofu to reinforce Ueda’s earlier comments that the central bank will continue to raise interest rates if inflation stays on course. He also clarified that the bank would need to monitor financial markets with “utmost vigilance” after the volatile period experienced at the beginning of the month.

Last week Governor Kazuo Ueda was summoned by parliament to explain the July decision to hike interest rates. Ueda reaffirmed his resolve to raise interest rates if inflation continues to meet expectations of 2% in a stable and sustainable manner.

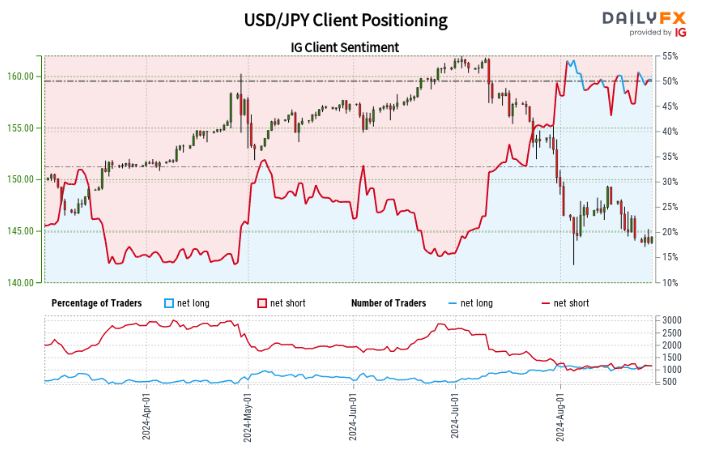

Retail trader information shows 51.35% are in long positions, with a long to short trader ratio of 1.06 to 1. Long positions have increased by 5.09% since yesterday and 6.11% from last week. Short positions have decreased by 2.41% since yesterday and 3.07% from last week.

When adopting a contrarian view to the market, with traders predominantly long, this implies USD/JPY may continue to decline.

The increase in net-long positions both from yesterday and last week, combined with current sentiment, strengthens the bearish contrarian trading perspective on USD/JPY.

USD/JPY Daily Chart with Sentiment Overlay

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX