US Dollar Weekly Forecast: Bullish

US Dollar May Prove Hard to Breakdown Ahead of PCE, the Major Catalyst

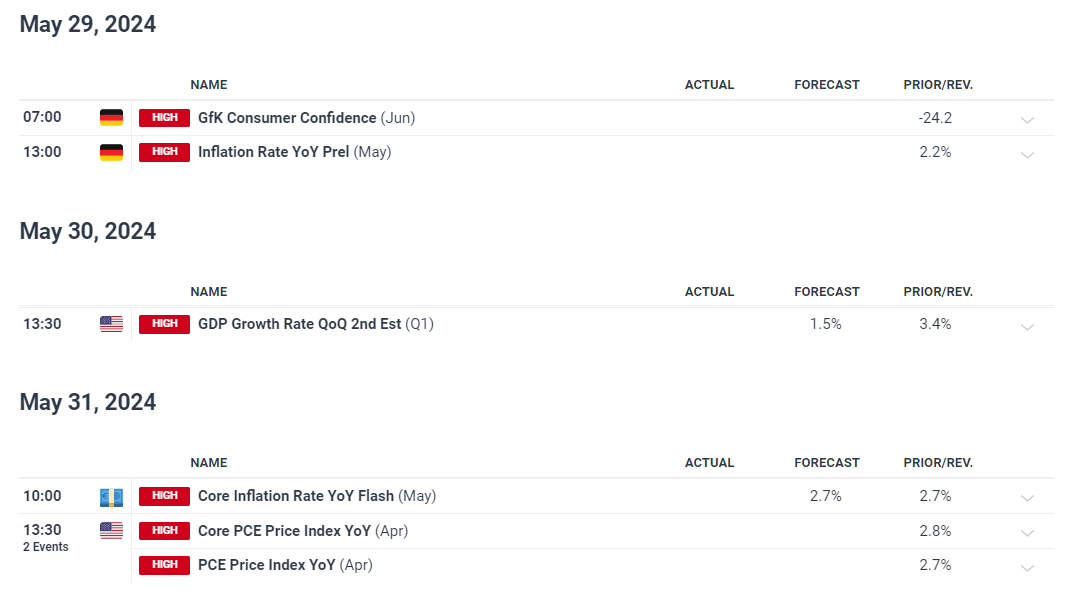

Risk events for the coming week are skewed towards the middle and latter stages of the week. On Wednesday inflation data out of Germany is likely to inform what the broader EU data is likely to serve up on Friday as inflation in the eurozone appears to be moving in the right direction. Just this week ECB president Christine Lagarde confirmed as much stating that she is ‘very confident’ that inflation in the eurozone is headed towards the 2% target.

Ben on Thursday we get the second look at US GDP for the first quarter, anticipating a slight decline in what was already a disappointing figure. However, the main event of the week is US PCE inflation data. Inflation in the US has been stubbornly high throughout the first quarter, and only last month have we seen a reprieve in the data – which will place a large focus on whether the PCE data tells the same story.

Customize and filter live economic data via our DailyFX economic calendar

Learn how to prepare for high impact economic data and news by following this easy-to-implement approach:

Recommended by Richard Snow

Trading Forex News: The Strategy

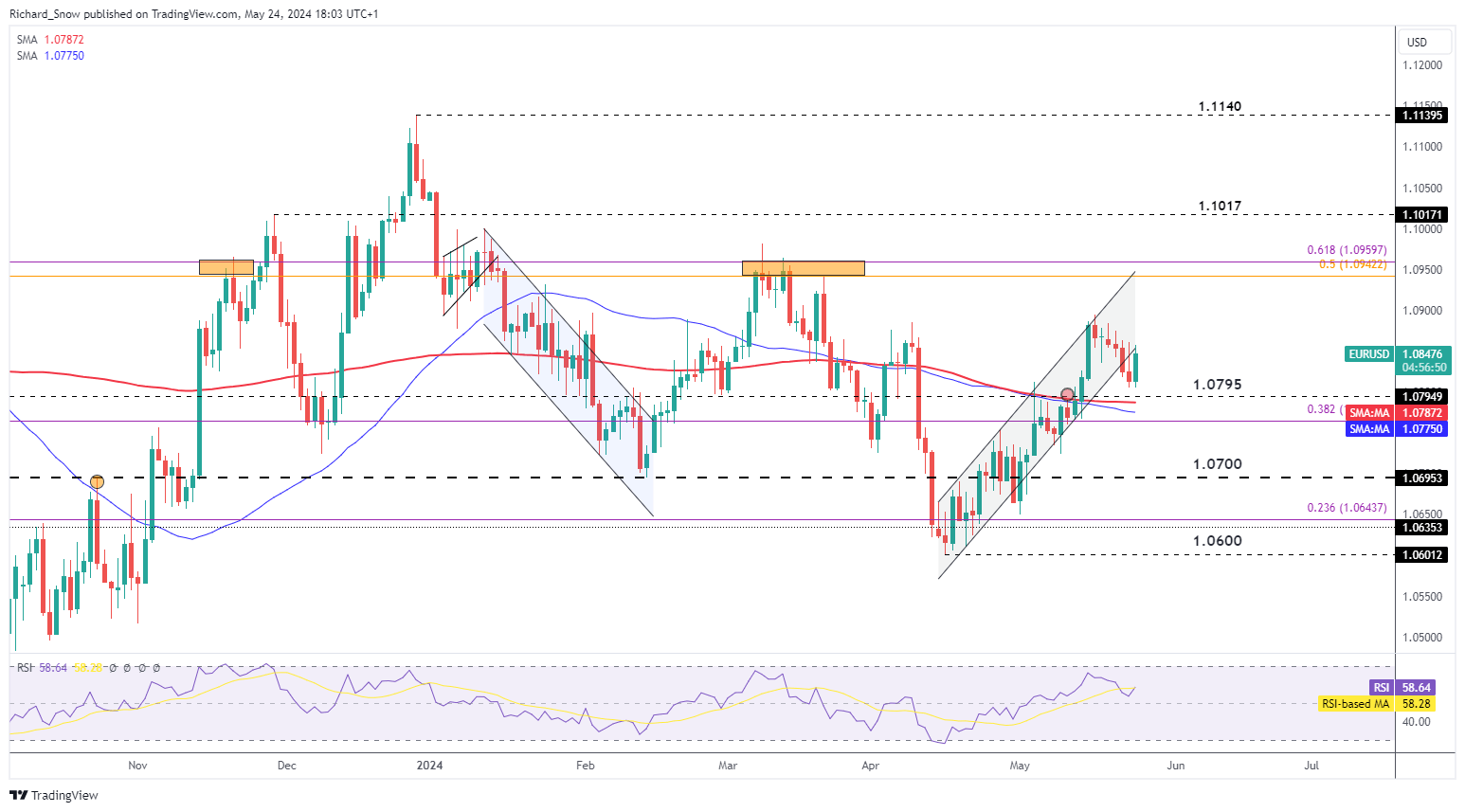

EUR/USD Drivers Remain Scarce as Markets Likely to Take its Cue from PCE Data

In the week just gone, the lack of high-profile US data led to lower volatility that favoured the dollar and treasury yields. During periods of lower volatility markets tend to follow the path of least resistance, more specifically, the FX market tends to favor higher yielding currencies over lower yielding currencies. With US PCE data only due at the end of the week, we could see a similar trading environment whereby the dollar continues to build on marginal gains until the big data point at the end of the week.

Better than expected survey data out of the University of Michigan consumer sentiment report on Friday revealed a step back in inflation expectations which spurred on temporary dollar weakness and a move higher for EUR/USD. The late partial recovery in EUR/USD provides a potential launchpad for EUR/USD bears at the start of the coming week.

Should inflation within the eurozone continue to weaken, starting with figures out of Germany, the euro may come under some pressure midweek. The pair may continue to ease into the June ECB meeting as a strong majority of ECB officials have communicated a preference for a 25 basis point cut next month. In contrast, the FOMC minutes from the May Fed meeting communicated a more hawkish approach and lack of confidence that inflation will move swiftly to the Feds 2% target – prolonging the ‘higher for longer’ narrative which naturally supports a stronger US dollar and US yields.

Lower German an EU inflation next week could see the pair trade lower, something that may be amplified by an underwhelming PCE print (stubborn inflation). Failure to make a new swing high at the start of the week opens up the rest of the week for a bearish move should the data comply. 1.0800 is the tripwire for a sell-off and the recent high of 1,0895 would need to be overcome on a daily closing basis to suggest a bullish continuation.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

EUR/USD is one of the most liquid currency pairs in the world, offering short-term trades with a cost effective and convenient market to trade. Discover the real benefits of trading liquid pairs and which pairs qualify:

Recommended by Richard Snow

Recommended by Richard Snow

How To Trade The Top Three Most Liquid Forex Pairs

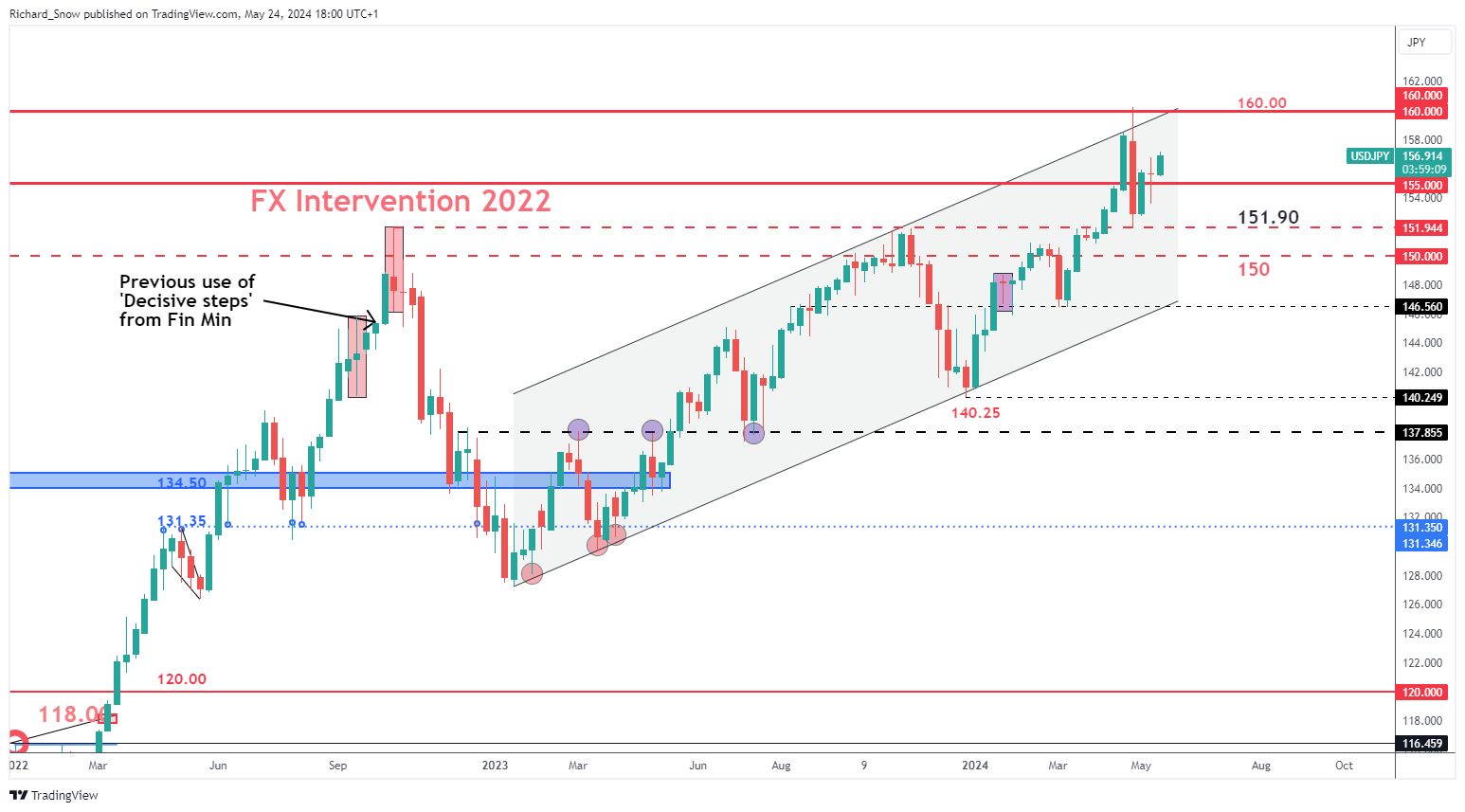

USD/JPY Uptrend Remains Intact after Weaker Japanese Inflation Data

During a week with fewer high-profile US economic data releases, the dollar was widely anticipated to recover, catering to the market’s inclination towards higher-yielding currencies in periods of reduced volatility.

USD/JPY Weekly Chart

Source: TradingView, prepared by Richard Snow

Less than a month since Japanese officials were believed to have intervened in the foreign exchange market, the USD/JPY exchange rate has once again approached the 160 level, which initially triggered their response. However, the upward movement has been more gradual this time, lacking the volatility that prompted Japanese officials to take action.

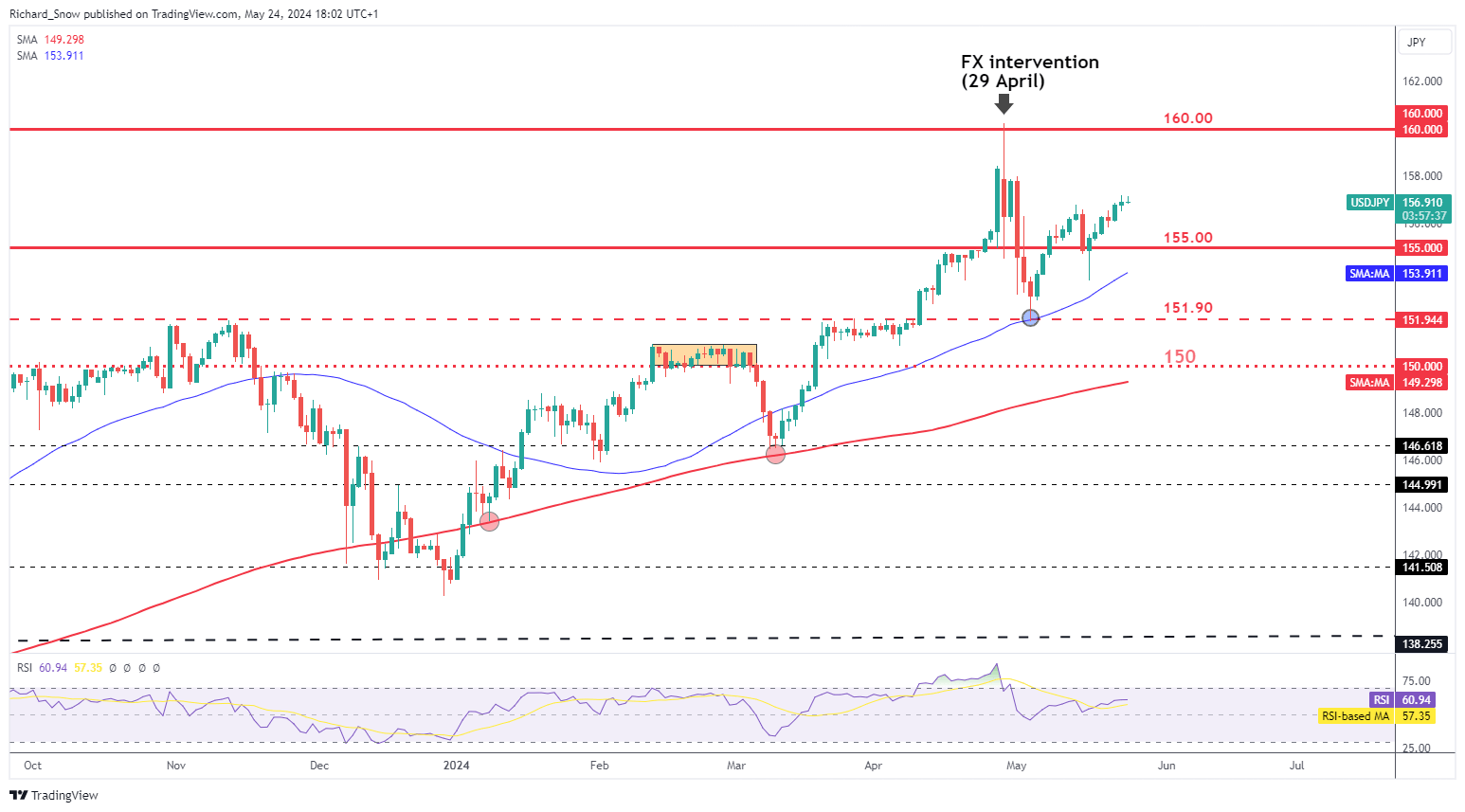

The USD/JPY pair is currently trading above 157.00, having rebounded strongly off the 50-day simple moving average (SMA) in early May and subsequently surpassing the 155.00 level. The issue of Japanese yen weakness is likely to persist as long as the significant interest rate differential between the United States and Japan remains intact. The carry trade continues to exhibit strength.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Learn the ins and outs of trading USD/JPY – a pair crucial to international trade and a well-known facilitator of the carry trade

Recommended by Richard Snow

How to Trade USD/JPY

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX