Fukuda Denshi is a leading Japanese medical device manufacturer. It offers a wide range of medical equipment products like, among others, defibrillators, patient monitoring, vascular screening -, ultrasound -, stress test – and respiratory systems. In addition, the company provides therapeutic instruments for sleep apnea syndrome and sells AED (automated external defibrillators).

Lately, the company has successfully expanded into the rental medical equipment for home care, including oxygen concentrator devices, which is starting to contribute significantly to the bottom line.

The Company holds high market share within Japan in several business segments that show significant growth, a duopolistic/ oligopolistic market structure and a secular tailwind due to the aging population.

The absence of promotional behavior (limited IR), low trading volume of the stock and no analyst coverage has created a stupendous value dislocation in absolute and relative terms seldom seen in my career as a security analyst and investor.

Basically, the company is a long- term compounder, trading at double liquidation value, spitting out an incredible amount of (growing) free cash- flow while investing significantly in future growth that is totally lacking attention of the Buffett style investors.

Overview of Operations

Over a time- frame of 18 years Fukuda Denshi was able to grow its turnover by roughly 4 % p.a.

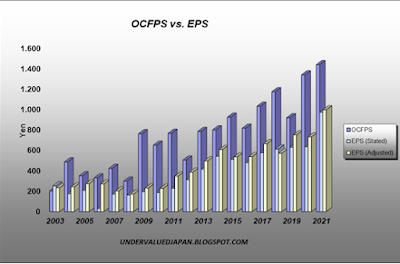

At the same time adjusted earning per share (EPS) has increased roughly 8 % p.a. and operating cash- flow per share (OCFPS) roughly 12% p.a. Since the start of Abenomics end of 2012 the growth rate is roughly 11% p.a. and 13% for both metrics.

Free Cash- flow per share (FCFPS) generation is Fukuda Denshi’s strong suit. FCFPS increased at an astounding rate of 16 % p.a. over a period of 18 years. Since Abenomics it slowed to roughly 13%.

General Valuation

Fukuda Denshi current stock price is 8’700 Yen.

Adjusted ROE for 2020 is roughly 11%. Return of invested capital (ROIC), basically the ROE metric adjusted for Fukuda’s high cash balance (Net Cash roughly 22% of Market cap), is with 19,5% significantly higher.

Liquidation value (incl. Investments) stands around 4’500 Yen per share.

For a Japanese company ROE, and especially ROIC, has to be regarded as high. At a stock price of 8’700 Yen an investor only pays 9 times earnings, 0.9 of book value and an incredible two times liquidation value.

But it gets even better, as price metrics are a very flawed metric, especially in Japan with its high net cash balances. The concept of enterprise value (EV), earnings before interest and taxes (Ebit) and earnings before interest, taxes, depreciation and amortization (Ebitda) adjusts for those flaws found in pure price metrics.

Relative Valuation

Fukuda Denshi’s main competitor on the Japanese market is the company Nihon Kohden. Thus, it lends itself to perform a comparative analysis of these two companies.

Already when comparing the stated price metrics and operating margins of those two companies, the value discrepancy becomes apparent. Although exhibiting almost the same operational efficiency, Fukuda Denshi is trading at a significant discount to Nihon in relation to book value and P/E Ratio. In addition, does Fukuda Denshi offer a significant better dividend and FCF yield.

But how steep Fukuda Denshi’s relative discount really is becomes only apparent with a comparative analysis on EV basis.

Whatever EV ratio you take into account, they all show that Fukuda Denshi trades only at a fraction of Nihon Kohden. And this for the company that has the higher ROIC and FCF yield!

In addition, when taking Fukuda Denshi’s significant investment portfolio into account the valuation discrepancy of those two companies become outright obscene.

Conclusion

Fukuda Denshi is a growth stock and compounder engaged in an attractive segment of the Japanese economy that has a structural tailwind due to demographics. The company does not show supercharged sales growth, but growth is highly profitable in terms of EPS and more importantly FCFPS.

Fukuda’s valuation is severely depressed in absolute and relative terms. The severe undervaluation only becomes apparent when the market cap is adjusted for the high balance of liquid assets and absence of financial leverage, i.e. a valuation on enterprise value basis is conducted.

Fukuda Denshi’s main competitor is Nihon Kohden. At current market price Fukuda Denshi trades at a fraction of Nihon Kohden’s multiples. At the same time Fukuda Denshi’s operational efficiency and dividend yield is higher, it has been investing more in future growth and growth is more valuable.

Disclaimer: Long Fukuda Denshi