British Pound (GBP) Latest – GBP/USD Analysis

- BoE hawk Catherine Mann is concerned about wage growth.

- Sterling’s recent revival continues, 200-dsma provides support.

Recommended by Nick Cawley

Get Your Free GBP Forecast

Bank of England MPC policy member Catherine Mann, one of four rate-setters who voted to leave interest rates unchanged at the last central bank meeting, warned this weekend that inflation may rise again in the coming months. Speaking to the Financial Times, Ms Mann said recent surveys suggest that, ‘There is an upwards ratchet to both the wage setting process and the price process and . . . it may well be structural, having been created during this period of very high inflation over the last couple of years” she added. “That ratchet up will take a long time to erode away.”

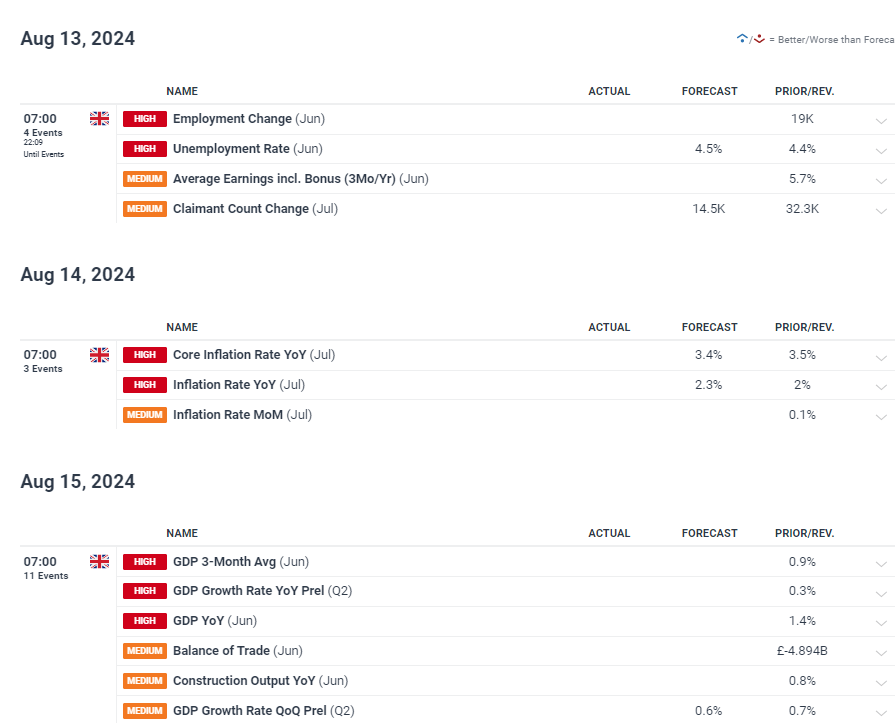

Ms Mann’s warning comes ahead of a busy economic release schedule with the latest UK employment, wages, inflation, and GDP data all set to be released over the coming days.

For all market-moving economic data and events, see the DailyFX Economic Calendar

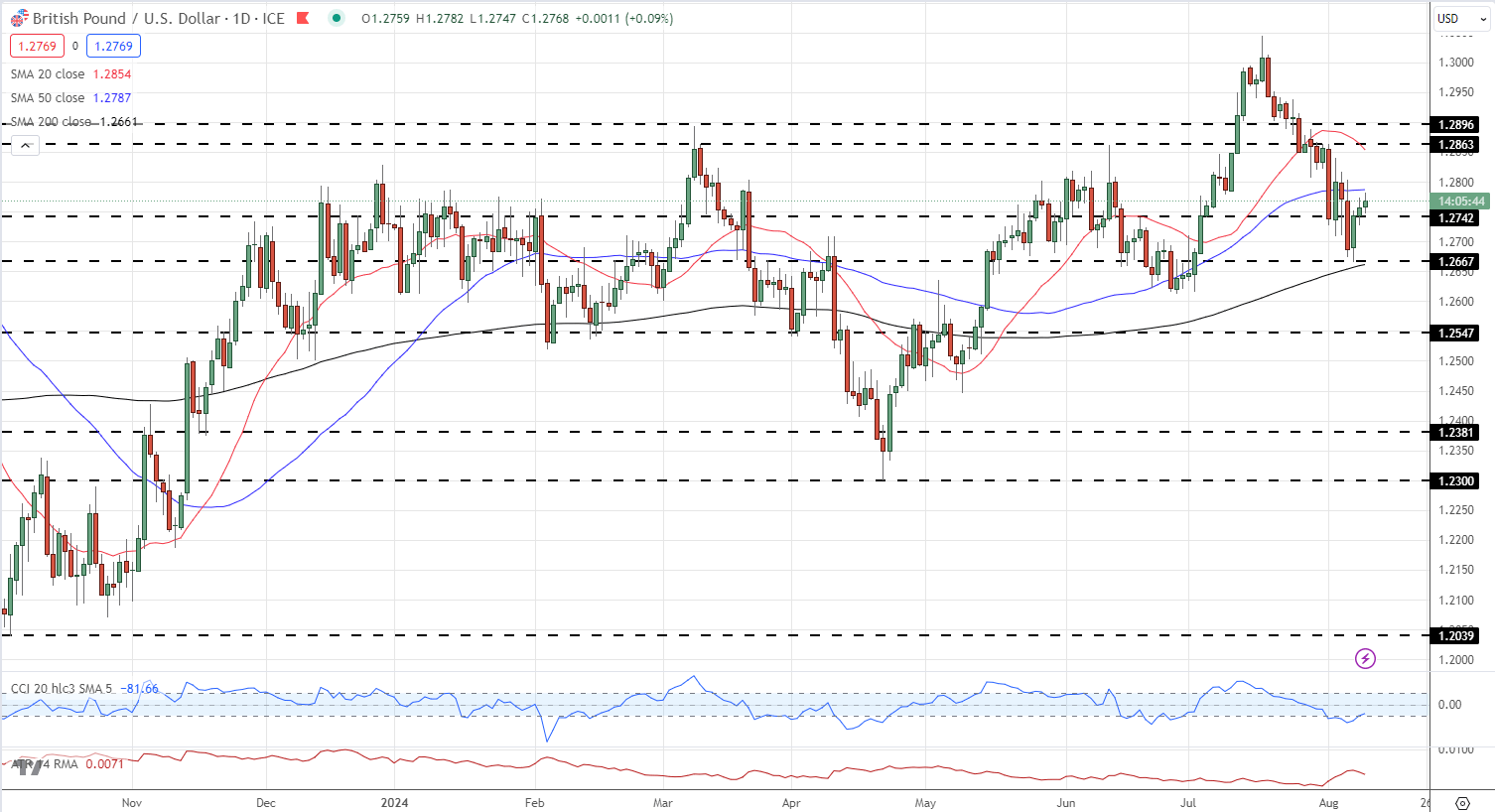

GBP/USD touched a multi-week low of 1.2665 last week based on Sterling weakness and US dollar strength. The pair has pushed higher since, helped by a supportive 200-day simple moving average, and currently trades around 1.2770. Cable is trying to break out of a sharp one-month downtrend after printing a 13-month high of 1.3045 on July 17, and this week’s economic data will decide the pair’s future. Support remains around 1.2665, bolstered by the 200-dsma at 1.2661, while near-term resistance is around 1.2863.

GBP/USD Daily Price Chart

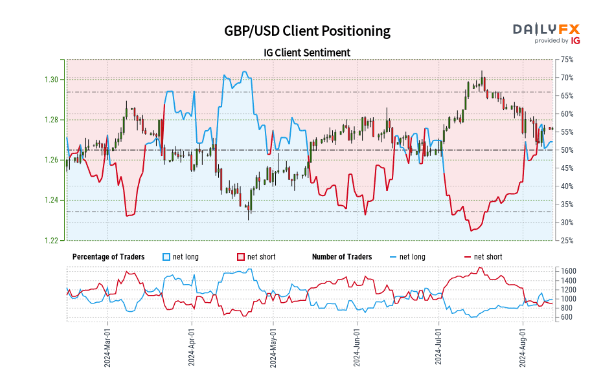

Retail trader data shows 51.94% of traders are net-long with the ratio of traders long to short at 1.08 to 1.The number of traders net-long is 0.92% higher than yesterday and 13.53% higher from last week, while the number of traders net-short is 0.44% higher than yesterday and 4.78% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 14% | 5% | 7% |

| Weekly | -17% | 26% | 11% |